This year has started well for share investors. The local NZX 50 index is up 3.6 per cent, following the positive trend across other global markets.

Expectations of a better year have fueled upbeat sentiment, an uptick in interest rates and a rotation out of the safer, more predictable companies into those more sensitive to a rebound in economic activity.

Read More

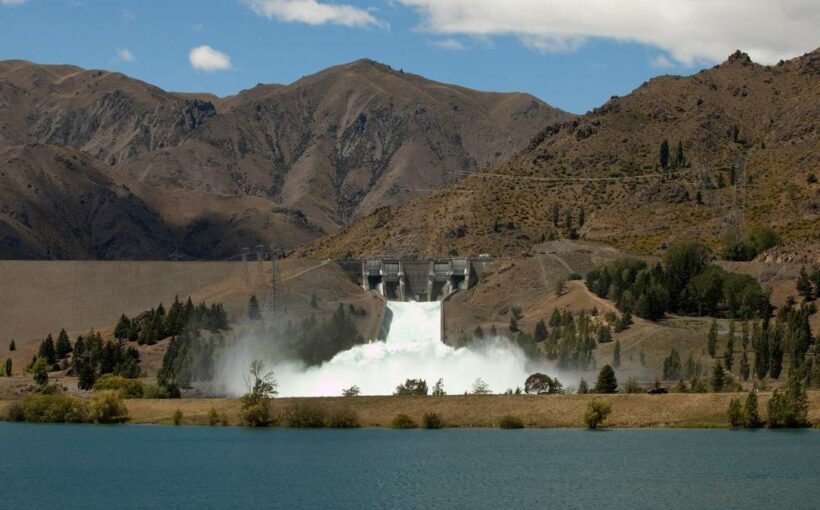

- Meridian Energy on the future of NZ’s $7b clean, green electricity

- Luke Blincoe: An open letter to Meridian Energy

Against that backdrop, it’s highly unusual for the five best performers in the NZX 50 to be electricity companies.

Mercury NZ and TrustPower are up more than 10 per cent, while Meridian Energy and Contact Energy have rocketed more than 20 per cent higher in just four trading sessions.

You’d think these companies would be dragging the chain this year.

Reliable, predictable businesses with high dividend yields were all the rage in 2020, as interest rates collapsed and the economy slumped into recession.

However, with interest rates having rebounded strongly from their October lows and the vaccine rollout in full flight, the focus has shifted from the safe places to hide to the recovery stories.

So what gives?

A big factor has been some significant buying interest from international clean energy exchange traded funds (ETFs).

ETFs are low cost, passive funds that track specific sharemarket indices and trade on stock exchanges just like regular shares.

They’re great for small investors because they offer instant diversification, while many large investors also find them useful for targeting sectors, regions or investment themes.

The clean energy ETFs have found themselves in the spotlight during the last week, partly on the back of the Georgia runoff elections in the US.

These saw the Democrats fare better than many expected, winning both seats. It effectively gives them control of the Senate for the next two years, once the casting vote of Vice President Kamala Harris is accounted for.

This means incoming US President Joe Biden has much better chance at enacting his policy plans, including a greater focus on renewable energy.

ETFs are open-ended, which means there’s generally no limit on how big they can get. As investor money flows into them, the ETF needs to buy more shares in its underlying holdings to match these funds.

Some of our electricity companies, notably Meridian and Contact, are quite large constituents of the clean energy ETFs.

As investors pour money into these to play the renewable energy theme under Joe Biden and the Democrats, the ETFs are required to buy more and more Meridian and Contact shares in response.

This buying happens mechanically, regardless of the asking price. There’s no analyst, fund manager or financial adviser sitting in the middle and making judgements on whether there is value to be had.

This indiscriminate buying demand has far outstripped the volume of sellers in the market in recent days, which is why the prices have been pushed up so dramatically.

One could now argue that prices have reached artificially high levels that aren’t supported by business fundamentals, despite the fact these are great companies with strong management teams and a bright future.

It’s difficult to predict where things go from here. If money keeps flowing into this space, the corresponding buying demand could keep pushing prices higher.

However, if at some point investors choose to sell their clean energy ETFs, shares in the underlying holdings would need to be sold as the process works in reverse, and this would see prices fall.

We might also see the ETF providers change the methodology for what’s included and how much, something that is under regular review.

If liquidity or availability of stock at reasonable prices is not up to standard, the likes of Meridian or Contact could find their weightings reduced and demand would fade.

For the time being, this has added a bit of spice to the first week of sharemarket trading. Existing investors probably aren’t too upset either.

The electricity sector is widely owned by private investors and fund managers alike. Virtually every KiwiSaver fund would have an exposure, to some degree.

In the case of Meridian, Mercury and Genesis Energy, the New Zealand Government remains the majority owner with a 51 per cent stake in all three. That means every one of us is a little wealthier than we were a week, indirectly at least.

Mark Lister is Head of Private Wealth Research at Craigs Investment Partners. This column is general in nature and should not be regarded as specific investment advice.

Source: Read Full Article