The near-term outlook for MCX Silver too is positive.

After three consecutive months of losing streak, the precious metals closed on a positive note for April 2021. The weakening of the U.S. dollar and the drop in the U.S. Treasury yields played a key role in pushing the precious metals to higher levels in April.

As a result, Comex gold gained 3% in April to close at $1,767.7 an ounce. The rise in Comex silver was much sharper, with the white metal gaining 5.5% to settle at $25.88 an ounce at the end of April.

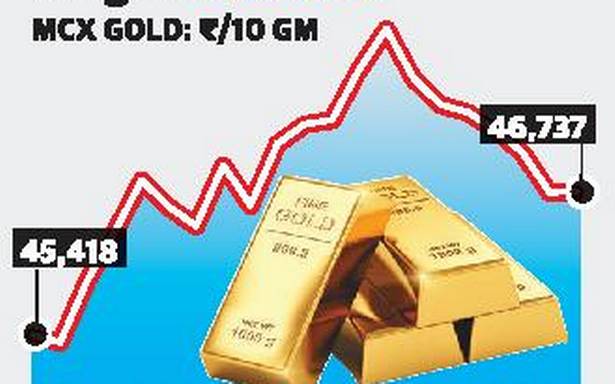

Mirroring the global trend, MCX gold futures gained 4% to close at ₹46,737 per 10-grams. MCX silver futures gained 5.7% to settle at ₹68,366 per kilogram at the end of April. The comex gold price achieved the target of $1,785-1,800 zone mentioned last month. The short-term outlook for comex gold remains positive. A close above $1,800 level would strengthen this view. Above $1,800, Comex gold could head to the next target at $1,845-1,855 zone.

The short-term positive outlook for gold would be under threat if the price closes below the immediate support at $1,710-1,720 zone. Until this support zone is breached, there would be a case for a rise to $1,855 or higher. The short-term outlook for Comex silver too is positive and the price could head to the immediate target at $27.7-28.5. The positive outlook would be under threat if the price drops below the support level at $24-24.5 zone. Until the support at $24 is not breached, there would be a strong case for a rise to $28.5 and beyond.

Mirroring the global trend, MCX gold too closed on a strong note in April and the price achieved the target zone of ₹46,750-47,000 mentioned in the previous post. The short-term outlook for MCX Gold is positive and the price is likely to move towards the next target zone at ₹48,500-49,500. This view would be invalidated if the price falls below the support level at ₹45,000-45,200 zone.

The near-term outlook for MCX Silver too is positive. MCX silver could rise to the immediate target at ₹71,500-72,000. This view would be invalidated if silver price moves below ₹63,500-64,000. A close above ₹69,900 would strengthen the positive case scenario.

(The author is a Chennai-based analyst/trader. The views and opinion featured in this column is based on the analysis of short-term price movement in gold and silver futures at COMEX & Multi Commodity Exchange of India. This is not meant to be a trading or investment advice.)

Source: Read Full Article