The restriction imposed on cryptocurrency services providers by China has made the entire digital currency market hit a snag. The price of Bitcoin, the largest crypto asset by market cap, has plummeted to touch the $30,000 level, a price that it last traded on Jan 02, 2021 (almost 6 months ago).

The Chinese government (the National Internet Finance Association of China, the China Banking Association and the Payment and Clearing Association of China) has come out to bar all financial institutions and payment firms from offering crypto asset-related transfers and payments and went ahead to warn citizens and other venture capitalists based in China against getting involved in Bitcoin (BTC) and cryptocurrency trading.

Cryptocurrencies are no longer tolerated in China

Ever since retail trading was restricted in the country, Chinese traders have been using darknet platforms and VPNs across several exchanges to trade digital currencies and one of the popular coins in the country has been Filecoin (FIL, $87.46), Luna Coin (LUNA, $0.006832), Enjin Coin (ENJ, $1.36), Bitcoin, Dogecoin (DOGE, $0.4052), Ethereum (ETH, $2,690.62) and many others. After the announcement from the government, the prices of all these cryptocurrencies that were popular in China have started to fall.

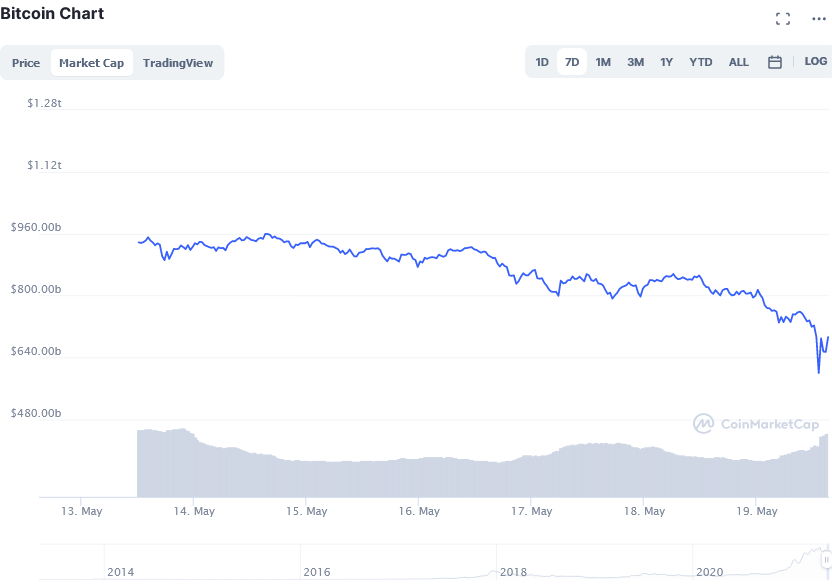

Following the news, the 24h price of Bitcoin dived and touched a low of $30,681.50 and this has never happened for the last 138 days. The trading volume also dropped to $77.76 billion and the market cap to $592.538 billion.

However, the collapse was short-term. As of May 20, BTC is trading at $40,386. Most other major cryptos have also turned green, except for Ripple and Binance Coin. Both assets are still registering losses with their prices in the red zone ($378 and $1.20 respectively).

Will the cryptocurrency industry survive without China’s backup?

Generally, the news about China restricting financial and payment providers from providing crypto-asset services has shaken and affected the entire cryptocurrency market, to the extent that the market cap has shrunk from $2.367 trillion to $1.35 trillion, representing a fall of almost 43%. The entire trading volume has also declined from $244 billion to about $241B, indicating a fall of 2%.

China being the world’s second-largest economy has a big influence in the financial industry, so any action on cryptocurrency has to affect the industry. Let us wait to see whether or not Bitcoin can again stand on both legs without support from the Chinese government.

Source: Read Full Article