More On:

warren buffett

Warren Buffett resigns as trustee of Bill and Melinda Gates Foundation

Bill Gates, Warren Buffett building nuclear reactor in coal-rich Wyoming

Bill & Melinda Gates Foundation weighs governance changes amid divorce fallout

Bill Gates hires firm led by Warren Buffett’s 97-year-old right-hand man for divorce

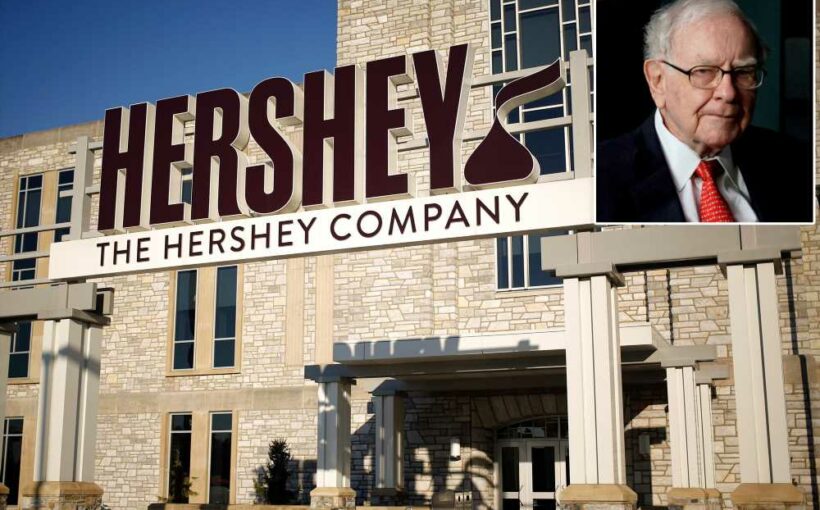

A jet owned by candy maker Hershey made an unusual trip to Omaha, Nebraska, the home of Warren Buffett, according to an analyst with a history of spotting deals through plane records.

Don Bilson, head of event-driven research at Gordon Haskett, said in a note Thursday that a plane tracked as being owned by Hershey made a June 12 trip to Omaha.

Bilson noted a Hershey jet hasn’t made a trip to the city “in at least a year.”

While pure speculation at this point, Bilson noted that the company’s Challenger 604 stayed in Omaha for a “couple of days which is certainly enough time for anyone who made that trip to pay the Big Guy a visit.”

Of course, it’s also possible Hershey was making a completely unrelated trip to Omaha, where the college baseball World Series began on June 19, and the US Olympic swimming trials ran from June 4 to June 20.

But Bilson also noted Buffett’s longtime affection for sweets and the companies that manufacture them. Buffett’s Berkshire Hathaway has owned See’s Candies for nearly 50 years. And Berkshire was involved in Mars’ acquisition of candy maker Wrigley in 2008.

Berkshire also owns about $21 billion worth of shares in Coca-Cola, and Buffett has joked that he’s “a quarter Coca-Cola,” saying in 2015 that he drinks at least five 12-ounce servings a day.

“Besides being an unapologetic junk food fan, Buffett has owned See’s Candies for 49 years,” Bilson said Thursday in his note. “He also participated in the 2008 purchase of Wrigley that was spearheaded by Mars and we have long thought that he was the perfect buyer for HSY. More than that, he may be the only realistic buyer who would win approval from the Hershey Trust.”

The Hershey Trust, which retains majority voting control of the stock, is led by 12 board members who would need to approve of any deal. Hershey’s market value is about $36 billion.

Berkshire is sitting on more than enough cash to make a deal for Hershey. The company’s cash pile grew to more than $145 billion by the end of the first quarter, slightly below the firm’s record level, which was set at the end of the third quarter last year.

And giving more weight to the speculation over one jet is Bilson’s reputation for spotting deals. In 2019, the visit of a Gulfstream plane owned by Occidental Petroleum to Omaha tipped Bilson off that Berkshire could be working a deal.

Days later, Berkshire announced the commitment of a $10 billion preferred stock investment in Occidental.

And later that year, Bilson again used so-called alternative data to predict Carl Icahn’s involvement in an activist investor battle at HP.

“We do not comment on rumors and speculation about our business, and this includes commenting on the movements of our aircraft,” Hershey spokesman Jeff Beckman said.

Representatives for Berkshire did not immediately return The Post’s request for comment.

Share this article:

Source: Read Full Article