- Shares of Softbank Group in Japan jumped 2.31%. The Japanese conglomerate is selling about one-third of its stake in ride-hailing company Uber to cover losses on its investment in Chinese ride-hailing company Didi, two people familiar with the matter told CNBC.

- The Federal Open Committee ended its two-day meeting by keeping interest rates in a target range between zero and 0.25%.

- Fed Chairman Jerome Powell said the U.S. central bank is nowhere near considering a rate hike despite the optimism over the U.S. economy.

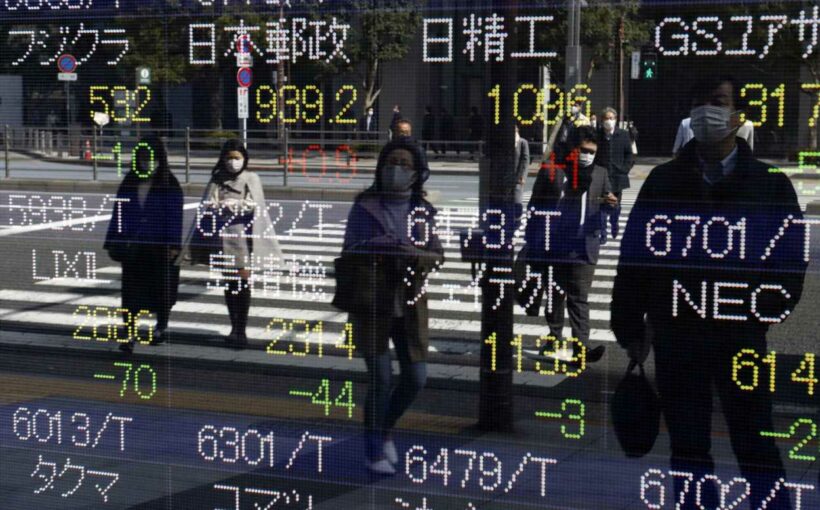

SINGAPORE — Shares in Asia-Pacific rose in Thursday morning trade, after the U.S. Federal Reserve left its benchmark interest rate near zero.

In Japan, the Nikkei 225 advanced 0.56% in early trade while the Topix index gained 0.43%.

Shares of Softbank Group in Japan jumped 2.31%. The Japanese conglomerate is selling about one-third of its stake in ride-hailing company Uber to cover losses on its investment in Chinese ride-hailing company Didi, two people familiar with the matter told CNBC.

Elsewhere, South Korea's Kospi rose 0.31% while the S&P/ASX 200 in Australia climbed 0.29%.

MSCI's broadest index of Asia-Pacific shares outside Japan traded 0.25% higher.

Looking ahead, Hong Kong's markets will be monitored by investors for signs of a further rebound from the more than 8% rout the Hang Seng index experienced over two days early this week.

Stock picks and investing trends from CNBC Pro:

BlackRock's Rieder says the Fed could begin tapering bond purchases in November

Morgan Stanley names 4 global stocks that are about to surprise markets to the upside

Here are Wall Street's favorite value stocks that should benefit from the economic reopening

Overnight stateside, the Dow Jones Industrial Average fell 127.59 points to 34,930.93 while the S&P 500 was little changed at 4,400.64. The Nasdaq Composite advanced 0.7% to 14,762.58.

The Federal Open Committee ended its two-day meeting by keeping interest rates in a target range between zero and 0.25%.

Fed Chairman Jerome Powell said the U.S. central bank is nowhere near considering a rate hike despite the optimism over the U.S. economy.

Currencies and oil

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 92.256 after a recent drop from around 92.7.

The Japanese yen traded at 109.84 per dollar, weaker than levels below 109.8 seen earlier in the week. The Australian dollar changed hands at $0.7377, above levels below $0.736 seen earlier this week.

Oil prices were little changed in the morning of Asia trading hours, with Brent crude futures largely flat at $74.73 per barrel. U.S. crude futures sat fractionally lower at $72.36 per barrel.

— CNBC's Jeff Cox contributed to this report.

Source: Read Full Article