Bitcoin and gold are probably common tools with which investors hedge against inflation today, but can be likened to two different players on the same team, asserts Jurrien Timmer, the Director of Global Macro at Fidelity Investments.

According to Timmer, the current price bubbles with Bitcoin are much similar to bubbles experienced with gold prices in the 1970s. The only difference is that gold price bubbles were smaller in the 1970s because inflation was much smaller than it is today.

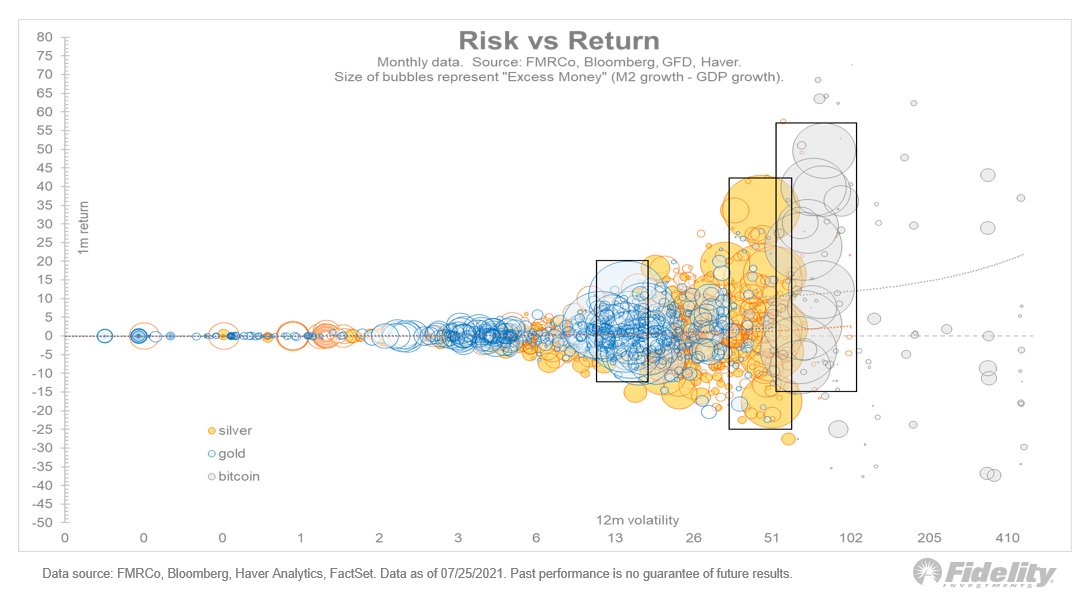

Bitcoin clearly wins against gold when comparing annual volatility versus monthly returns for both, he says. The risk versus return chart shows Bitcoin generating returns of over 10 million more than gold but obviously, Bitcoin is the riskier of the two.

In comparison to other assets, Bitcoin currently scores high volatility of 42.3 against Oil 16.8, US Stocks 7.79, and gold 4.2. That is when volatility is considered over a third-day period for all the assets. However, Bitcoin has beaten all the other assets in risk-adjusted returns since 2014.

For instance, Bitcoin risk-adjusted return currently stands at 2.39 against gold’s 1.44 and US stocks’ at 1.7. Bitcoin also outwits US bonds and real estate in risk-adjusted returns since 2014. Woobull measures risk-adjusted return for an asset over a four-year period.

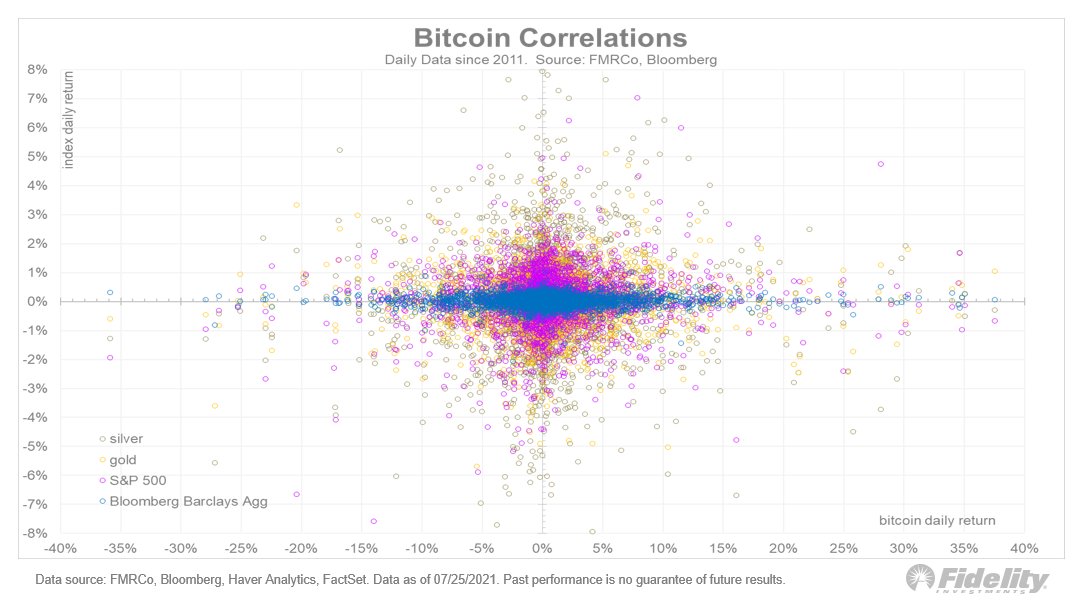

“For all the debate about bitcoin, one thing that hasn’t changed is its lack of correlation to other asset classes,” said Timmer.

When comparing Bitcoin’s daily returns to the daily returns from the S&P 500 index, Barclays Aggregate, and gold, Timmer says that it is unclear whether Bitcoin is still profitable. However, the daily returns comparison is not a good measure of showing the performance of an asset against another. Timmer also claims that gold and silver may experience a significant uptick in the future if TIPS break-evens catch up to the Consumer Price Index and Fed continues to repress nominal rates such that real rates would be negative.

Source: Read Full Article