It is no secret that the traditional credit system is one of the most critical components of the financial world. These systems are often the gatekeepers of access to financial products for individuals.

In order to get loans, for example, a consumer’s credit score is typically consulted and depending on their current credit situation, they might either be accepted or denied.

However, current credit scoring systems are considered by many to be antiquated, punitive and lead to people being left out of the system.

This is driven by a focus on derogatory marks, the lack of using alternative data that could be better indicators of creditworthiness, a lack of transparency on what makes your credit score go up and down and the lack of cross-border credit scoring.

With DeFi, the blockchain sub-sector that has seen a boom in growth over the last few years, the hope was financial inclusivity and global access would flourish without gatekeepers and archaic infrastruc holding things back.

In reality, while growth has been impressive, collateralized lending has been the standard, limiting access to those with assets to stake.

This is because while it’s easy to leverage collateral in crypto, it’s difficult to prove who you are, and your creditworthiness, while still maintaining user privacy and the core principles of decentralization.

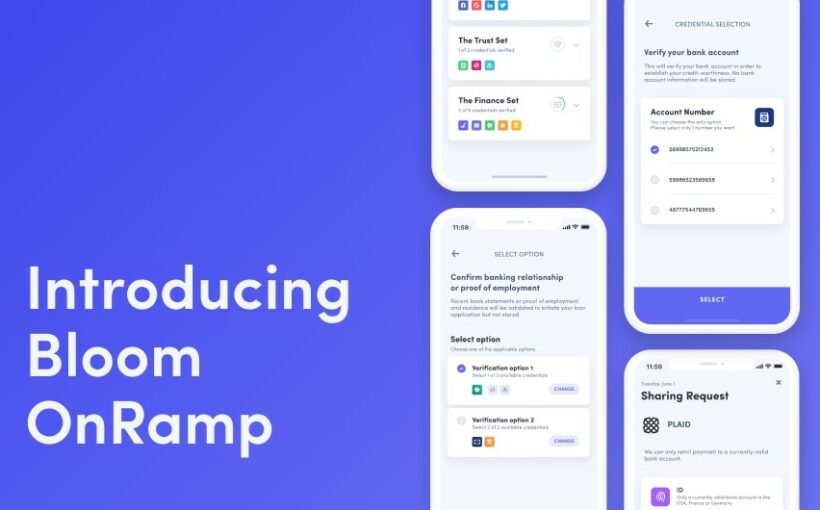

Now, the process of securely assessing risk without sacrificing user privacy has been made possible by a new product by Bloom, a blockchain company focussed on digital identity and reusable, verifiable credentials. The product in question is called OnRamp and it was formally unveiled on October 14, 2021.

All About OnRamp

As per the official announcement, OnRamp is a tool that allows companies, particularly DeFi ones, to verify user data while still preserving their privacy.

Given that privacy is a major selling point of DeFi firms, this will likely be embraced by the industry.

In order to help DeFi companies expand beyond collateralized loans, OnRamp allows access certain relevant financial information such as bank account activity and balances in order to determine creditworthiness.

Eventually, there are plans to allow for the viewing of traditional credit scores and other information to assess risks and make decisions regarding loans.

OnRamp also allows firms to verify customer identification information without actually requiring the customer to give up their sensitive information.

With this, firms can conduct ID verification, sanction screening and PEP Screening. Some of the identifying information that can be confirmed also includes phone numbers, email addressed as well as social accounts.

This will go a long way to ensure that DeFi firms can actually stay compliant with KYC and AML requirements without compromising on the privacy options that have made them so popular among customers.

It will also help DeFi companies see new growth as the industry expands. Currently, not enough DeFi companies are compliant with regulations around the world and if these companies hope to reach their full mainstream potential, this has to change.

With OnRamp, however, they can make this change without removing one of their core values.

“We are excited to give enterprises the ability to leverage verifiable credentials for identity verification and risk assessment, all while respecting user privacy and mitigating the risk of data leaks,” said Jace Hensley, Head of Platform at Bloom.

Another amazing feature of OnRamp is the ability for third-party credentials to enter the OnRamp platform via the WACI specification. This aids financial inclusion as local populations that are not currently catered to by existing financial infrastructure.

“ Now third party data sources around the world can enter the platform, giving the opportunity for people outside of the standard financial system to prove reliability and creditworthiness. This is a major step for DeFi to go global and truly expand financial inclusivity,” added Hensley.

More announcements are expected from the company following the rollout.

Source: Read Full Article