The crypto economy has allowed quite a few currencies to prevail and provide for different markets by catering to very different needs and demands. Other than the speculative interest that stands behind the support for many cryptocurrency tokens, the few tokens that have services behind them are basing at least a part of their value on demand for the service or their technology in general. By extension, this would mean that price movements of said cryptocurrencies are affected by a multitude of factors, aside of market wide speculation.

Correlation

Correlation in assets is the degree by which they move in relation to each other. Positive correlation between certain cryptos would mean for example, that a movement in the price of one wouldn’t be observed alone, as the price of the other positively correlated ones would also experience movements to the same direction at the time. The degree by which those price movements would be similar determines the level of correlation, with negative correlation between two assets meaning that their prices move in opposite directions.

There are of course rare cases in which price movements of certain assets seem to not be correlated, and that’s when correlation is low. A portfolio manager would would strive to gather sets of assets that have low or perhaps negative correlation.

This is especially hard to observe within the crypto economy provided that all cryptocurrencies are trading within the same economy and are more or less receiving funds by groups of people with similar interests. However, the difference in the services some currencies provide makes it so the different markets interested in each help for a lower correlation.

The Recent Months in Crypto Markets

It’s worth noting that a positive correlation could help maximizing profits at times of a market wide bull run like the one cryptocurrencies experienced recently within the last few months. This mindset likely contributed to a rise in the mid term correlation between all cryptocurrencies as well but could be changing very soon.

As bitcoin, the market leader in cryptocurrency, starts having difficulties surpassing resistance and countering selling pressure after a fall from the rally’s all time high, risk starts being taken into account more. Now, provided that high correlation is also maximizing risk, it wouldn’t be wise to invest in cryptocurrency portfolios that provide high risk whereas asset diversification could help reduce it.

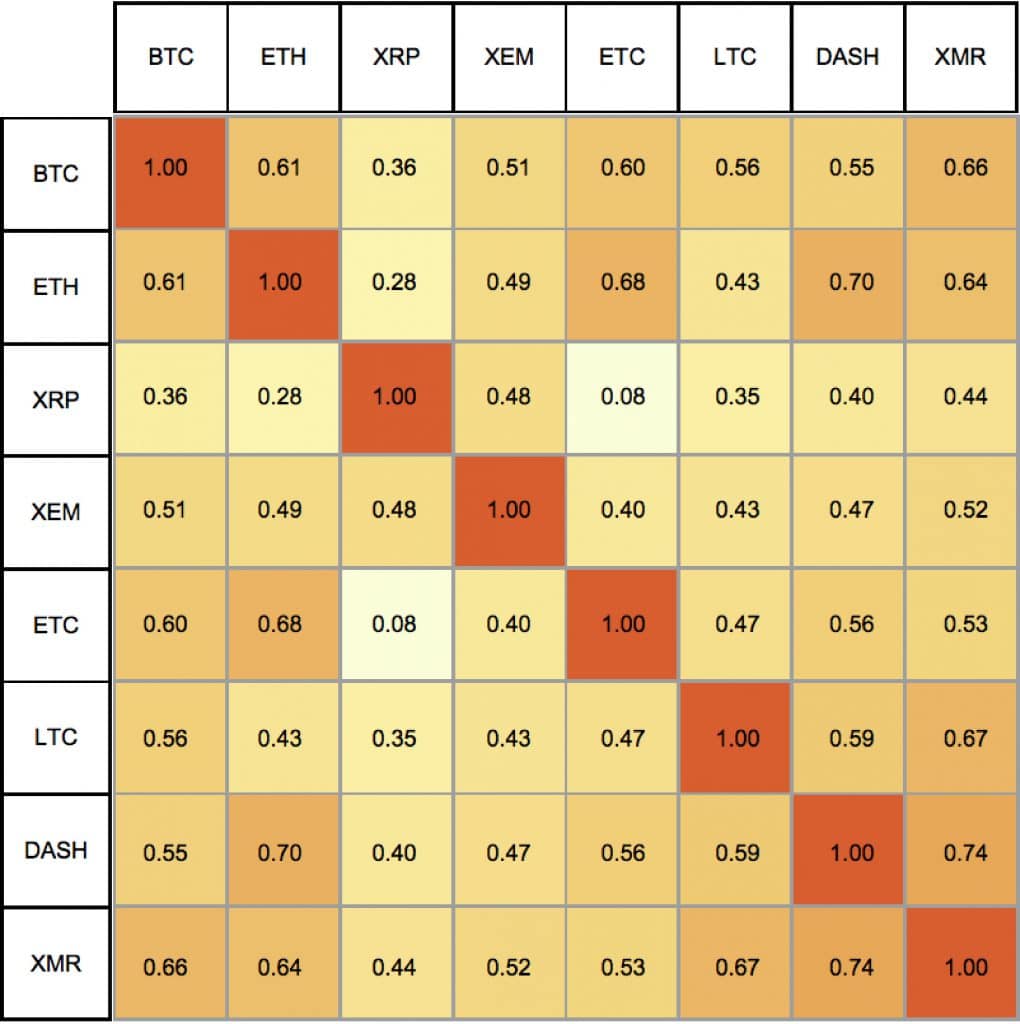

The question arising from all this would be what cryptocurrencies have low correlation. To come to an answer one needs to analyze equal amounts of past data for cryptocurrency pairs. Thankfully, some data analysts at sifrdata are providing cryptocurrency users with a rolling 90 days analysis of past data for pairs of popular cryptos. This matrix is nevertheless indicative of how correlation between all those pairs has changed within the last few months.

- XRP/BTC continue to maintain an especially low correlation.

- The correlation between ETC/ETH and XMR remains below average, with the one between XRP/ETC being the lowest of all.

- High correlation between anon coins (XMR, DASH) and BTC, as well as between them, with the one between DASH/XMR being the highest of all.

Most noteworthy of all however is the market wide trend that has lead us here. A user captured matrix from the same website showed multiple negative correlations little more than a month ago. This behaviour might be ending especially soon as the recent bearishness could be signaling the end of the bull rally and this highlights the importance of minimizing risk.

Source: Read Full Article