Russia's alliance with China a 'turning point in security'

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

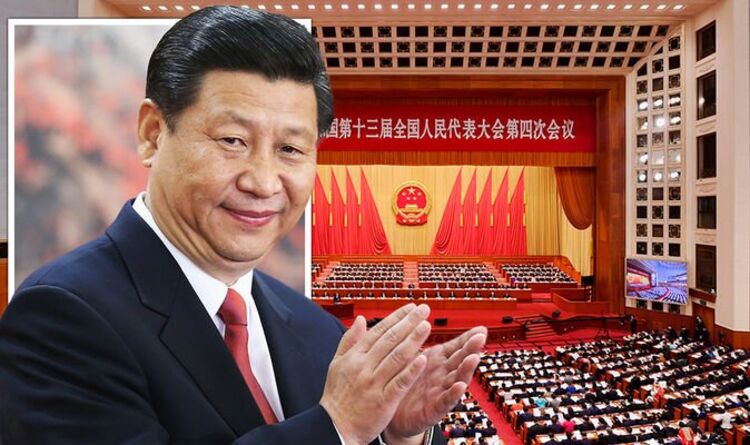

The National People’s Congress — the annual meeting of China’s parliamentary body — will kick off on Saturday, March 5, in the Great Hall of the People in Tiananmen Square. Premier Li Keqiang will deliver the 2022 work report, which policy insiders and analysts expect will unleash fiscal spending and tax cuts to spur investment and consumption to ease an ongoing slowdown and stimulate growth.

All eyes are on the twice-a-decade meeting of the Communist Party, due this autumn, in which President Xi Jinping will almost certainly secure a precedent-breaking third term.

Above all else, policymakers will seek to stabilise the economy, rather than make any great overhauls, to ensure nothing goes wrong ahead of this key moment.

Xu Hongcai, deputy director of the economic policy commission at the China Association of Policy Science, said: “Stability overrides everything before the 20th Party Congress.

“We need to create an environment for stable development.”

China’s economic recovery from the Covid slump was strong initially, but analysts now agree that all signs indicate a loss of momentum from the middle of 2021.

Debt problems in the property market, strict zero-Covid policy measures and wobbly consumer confidence have all taken their toll on the world’s second-largest economy.

The situation is further complicated by the war in Ukraine, with markets rattled and China facing criticism from the West for failing to condemn Russia’s actions.

There are growing concerns that any sharper economic slowdown could stoke job losses.

A Chinese government adviser, who spoke to Reuters on condition of anonymity, said: “This year’s parliament session will focus on how to cope with economic pressures, stabilise growth and employment.”

And Yang Chaohui, a politics lecturer at Peking University, said the event would be “low-key”.

He said: “I anticipate delegates will be extra prudent this year and avoid airing alternate views on hot-topic issues such as the zero-Covid policy, common prosperity or China’s position on Ukraine.”

Analysts expect China to target growth of between five and 5.5 percent for 2022.

Two key facets of Chinese fiscal balancing – the annual budget deficit ratio and a special local government bond quota – are expected to be largely in line with the targets set for 2021.

Meanwhile, the central bank has started cutting interest rates and pumping more cash into the economy, while local governments have sped up infrastructure spending in a bid to counter the slowdown.

DON’T MISS:

World War 3: Would China fight alongside Russia in WW3? [INSIGHT]

China ‘knew about Russian invasion’ as Xi ‘asked Putin to DELAY war [REPORT]

China admits it ‘deeply regrets’ Putin’s invasion of Ukraine [REPORT]

Another cornerstone policy will see greater tax and fee cuts unveiled, while stepping up payments to local governments to offset the hit to revenue, finance minister Liu Kun said this week.

Tax fee cuts on goods – a system whereby consumer spending power can increase, leading to higher economic growth – will be larger in 2022 than last year’s 1.1 trillion yuan (£129billion) in cuts, Mr Liu told a news conference ahead of this weekend’s meeting.

Reforms that could hurt growth are likely to take a backseat.

These include a long-awaited property tax, which, under President Xi’s push to achieve common prosperity, Beijing hopes could cool housing speculation and reduce the massive Chinese rich-poor gap.

However, analysts believe any new property tax trials are expected to wait until the second half of 2022, when the housing market is expected to stabilise

In the meantime, regulators have marginally loosened property financing curbs to ward off debt defaults.

But with the looming decision on President Xi’s third term, analysts don’t expect much to grab headlines from the upcoming meeting.

Wang Jun, chief economist at Zhongyuan Bank, said: “When the economy faces relatively big pressures, it is not a good time for pushing forward drastic reform measures.”

Source: Read Full Article