NEW YORK (Reuters) – Fallout from Russia’s invasion of Ukraine may be setting the stage for more gains in the dollar, upending investor expectations for a weaker greenback as geopolitical uncertainty and worries over European growth raise the U.S. currency’s appeal.

The U.S. Dollar Currency Index, has surged 3% year-to-date to its highest level in 21 months, buoyed in part by investors seeking shelter from market volatility that has hammered stocks across the globe and fueled wild swings in commodity prices. Russia calls its actions in Ukraine a “special operation.”

How much further it runs may depend on the paths taken by the Federal Reserve and European Central Bank in their efforts to normalize monetary policy. While investors are betting the Fed will likely push through several rate increases this year to fight surging inflation, many believe the ECB faces a tougher slog, with soaring raw materials prices posing a greater threat to Europe’s energy-dependent economy.

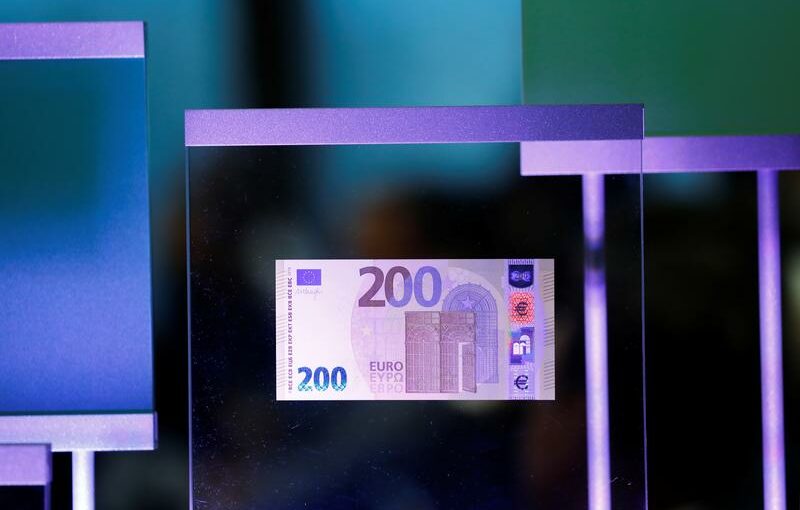

Bets on a widening gap in yields between the U.S. and euro zone have helped drag the euro near its lowest level against the dollar in more than two years. The currency was down 0.8% against the dollar Thursday afternoon despite a surprisingly hawkish shift from the ECB at its monetary policy meeting.

“The view at the start of the year that the euro would appreciate after a couple of months of dollar strength has taken a bit of a setback,” said Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

The recent price action in the two currencies runs counter to what many investors had expected earlier this year, after a hawkish pivot Fed rhetoric helped the dollar rise 6.3% in 2021. Strategists polled by Reuters at the end of January broadly expected the dollar to tread water, while forecasting that the euro would rise by 1.5% over the next 12 months.

“Everything that created that bullish case for the euro earlier this year now creates a very bearish case,” said Eric Leve, chief investment officer at wealth and investment management firm Bailard.

While Leve had started the year expecting the euro to strengthen at the dollar’s expense, he has now trimmed exposure to European equities and is looking to hedge euro currency risk.

A sustained rise in the dollar could have broad implications for markets and the U.S. economy. Though a strong currency tends to weigh on the profits of domestic exporters, it could also help the Fed tame inflation, which recently logged its largest annual increase in 40 years. Conversely, a weaker euro could exacerbate already high consumer prices in the euro zone.

Markets are pricing the fed funds rate to rise by more than 165 basis points in the U.S. this year, starting with a widely anticipated increase at next week’s Fed meeting. ECB rate hike expectations firmed on Thursday, with markets pricing around 43 basis points’ worth of interest rate hikes this year.

The ECB on Thursday said it would end asset purchases in the third quarter and ramped up inflation forecasts, but also pared its growth outlook.

Analysts at Nuveen said earlier this month that a Brent crude price of $120 per barrel would sap two percentage points from growth off the euro zone, compared to one percentage point from the United States, due in part to the country’s greater domestic energy supply and lower taxes.

“There is much more fear on this side of the pond, and I think that’s going to reflect itself in the ECB,” Aashish Vyas, investment director at Resonanz Capital, a Frankfurt-based hedge fund investment advisor.

Robin Brooks, chief economist at Institute of International Finance, wrote earlier this week that the euro can fall below $1.00 as markets adjust to “a major adverse shock to the euro zone.” The currency recently traded at $1.0987.

Some believe dollar strength will moderate later this year.

Steve Englander, head of global G10 FX research at Standard Chartered, believes the Fed will deliver less rate hikes than expected and the war in Ukraine will ebb, leaving the euro at

$1.14 by year-end.

But in the near term, there may be a little bit more pain for the euro, said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi US.

“Just north of parity is probably the trough in the euro,” said Upadhyaya, who is maintaining a short euro position for now.

Source: Read Full Article