Indians spent more on foreign investments during the past 12 months than they have since at least 2012.

Indians spent more on foreign investments during the past 12 months than they have since at least 2012, even as local exchanges have sought to make foreign offerings available through subsidiaries at the Gujarat international finance centre.

The total amount of money that Indians sent abroad for foreign investments is $673.8 million shows the latest data for December 2021.

This is 63.8 per cent higher than the December 2020 figure.

The numbers were $411.3 million for December 2020 and $452.1 million in December 2019, before the pandemic began.

The analysis shows a sharp rising trend in recent times (please see chart 1).

The analysis looked at a 12-month rolling period. The Reserve Bank of India releases the data with a lag. The December data came out in February.

The National Stock Exchange announced a facility to trade in foreign stocks on March 3rd.

The BSE announced that it provides a platform for trading in foreign stocks on March 2nd.

Both operate through their arms at the Gujarat International Finance Tec-City International Financial Services Centre (GIFT IFSC).

The international finance centre is being pushed as an alternative to investors who come through jurisdictions such as Singapore.

‘Investors will be provided with an option to trade in fractional quantity… starting with US stocks, NSE IFSC will soon expand its offering to other global markets,’ said a statement from the NSE arm.

‘The India International Exchange (IFSC) Limited (India INX)… provides a platform for trading in international stocks, including shares from major US-listed companies… It offers stocks from the US, Canada, UK (United Kingdom), Europe, Australia, and Japan, covering about significant percent of the investing universe,’ according to the BSE arm.

The use of remittances to make foreign property purchases has also been rising.

However, the rise is far sharper for non-property investments.

Indians remitted $3.9 million dollars for foreign investments for every $1 million invested in foreign property as of March 2012.

This rose to $6.7 million for every $1 million in foreign property investments by December 2021.

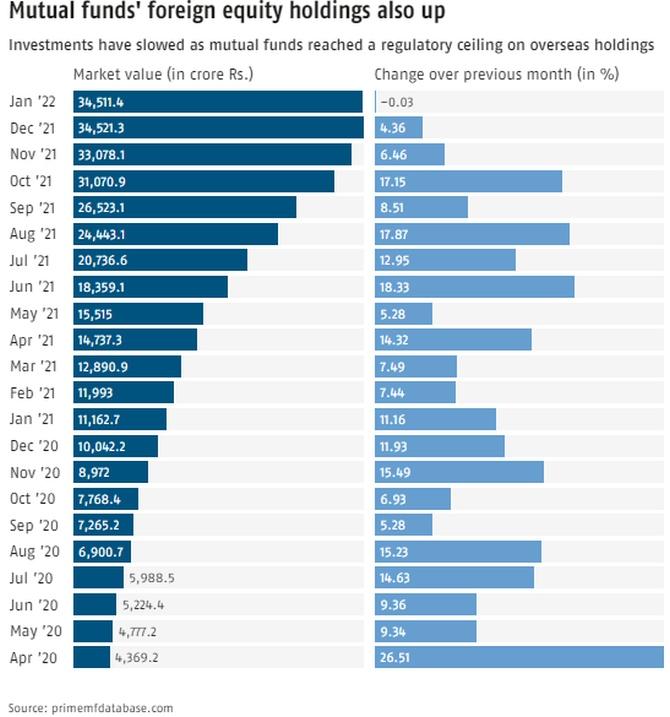

The surge has coincided with mutual funds holding more foreign securities.

The total value of their investments had risen to Rs 34,511.4 crore (Rs 345 billion) as of January 2022, shows data from tracker primemfdatabase.com.

It is up more than 7.9 times over April 2020 (see chart 2).

There has been a significant decline in the growth rate in the last few months. This is because of mutual funds nearing a ceiling on their holdings.

‘Mutual Funds can make overseas investments subject to a maximum of US $1 billion per Mutual Fund, within the overall industry limit of US $7 billion,’ said the Securities and Exchange Board of India circular dated June 2021. The value of holdings has nearly doubled since then.

Reports have indicated that the industry has sought a higher ceiling.

The month-on-month change was negative for January 2022.

This is the first such instance since at least April 2020. The growth rate in April was 26.51 per cent.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article