New York (CNN Business)The first rule of running the Federal Reserve is: You do not criticize the Federal Reserve.

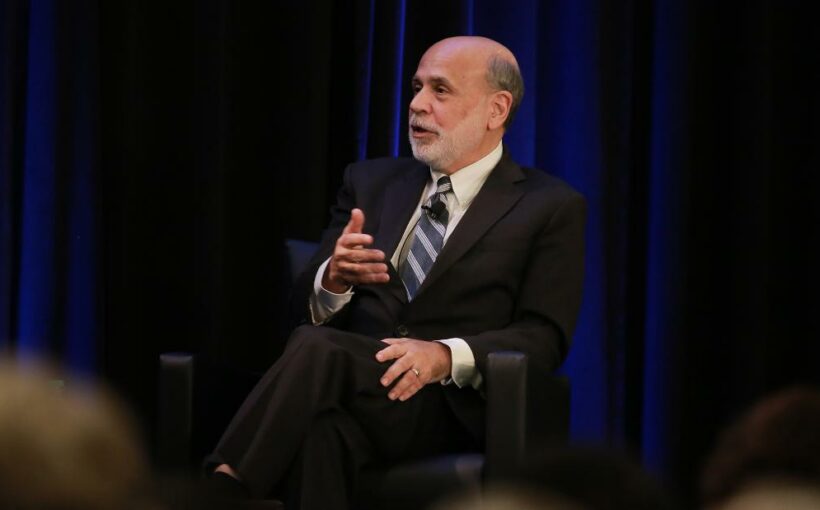

An unspoken edict amongst former Fed chairs has been to not speak ill of their successors to preserve the apolitical nature of and trust in the institution. But former Fed Chair Ben Bernanke broke those rules on Monday morning when he said that the central bank had erred in its approach to addressing 40-year-high inflation.

“The question is: Why did they delay that? … Why did they delay their response? I think in retrospect, yes, it was a mistake,” he said during an interview on CNBC’s Squawk Box Monday. “And I think they agree it was a mistake.”

Bernanke led the Fed through the financial crisis of 2008 and oversaw incredible levels of monetary expansion. His successors Janet Yellen and then Jerome Powell, who now runs the central bank, continued the loose policy well into economic recovery.

Powell recently announced rate hikes and a reduction of bond holdings to fight rampant inflation, growing at an 8.3% annual pace. But some critics, including Bernanke, say he waited too long to tighten policy.

Still, Bernanke acknowledged the whole situation is “complicated, adding that he understands why Powell decided to wait.

“One of the reasons was that they wanted not to shock the market,” he said. “Jay Powell was on my board during the Taper Tantrum in 2013, which was a very unpleasant experience. He wanted to avoid that kind of thing by giving people as much warning as possible. And so that gradualism was one of several reasons why the Fed didn’t respond more quickly to the inflationary pressure in the middle of 2021.”

Bernanke also warned in the interview with CNBC’s Andrew Ross Sorkin that stagflation may be imminent.

“Even under the benign scenario, we should have a slowing economy,” he said. “And inflation’s still too high but coming down. So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high. So you could call that stagflation.”

Former New York Fed president Bill Dudley has also spoken out against Powell’s timing and said a soft landing will be nearly impossible to execute.

“The problem the Fed faces is they’re just late,” Dudley said.

Source: Read Full Article