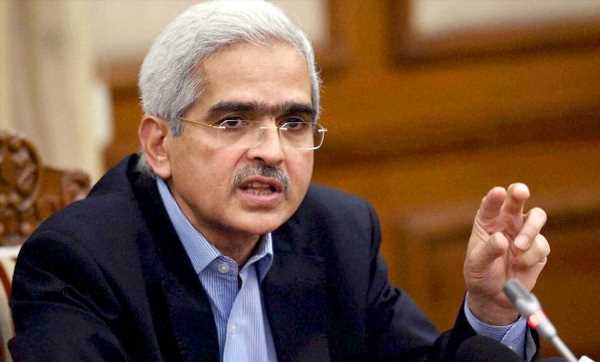

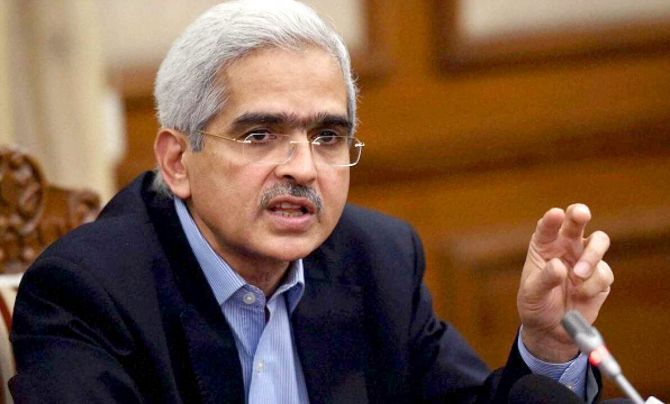

The increasing involvement of Big Tech in the financial system could give rise to concentration risk and there are potential spillovers, which call for closer attention, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Tuesday.

“…enormous amounts of consumer data is being generated and leveraged upon by a few entities (the so-called Big Tech) by virtue of their huge customer base.

“Such developments raise concerns on concentration risk and potential spillovers as their level of engagement with the financial system strengthens in the years to come,” Das said at the Global Fintech Fest 2022.

“Therefore, potential risks to public policy objectives of maintaining competition, market and business conduct, operational resilience, data privacy, cyber security and financial stability need closer attention,” he said.

RBI — in the past — had flagged the increased engagement of Big Tech in the financial services space, which has implications for financial stability.

Big Tech companies such as Google, Amazon, and WhatsApp are already involved in India’s payment ecosystem, involving Unified Payments Interface (UPI).

The regulator has said that use of digital channels in financial services is a welcome move.

However, the potential downside risks embedded in such endeavours need to be addressed.

Das also flagged the unbridled mushrooming of digital lending apps, saying the need of the hour is to ensure safety after following a process of green-lighting (white listing) and due diligence by regulated entities.

The RBI, in association with other agencies, is taking steps to address this issue, and will take further steps, if necessary.

Speaking about the recently-issued digital lending guidelines, Das said, the guidelines strike a well-considered balance between customer protection and business conduct, on one hand, and supporting innovation on the other.

Digital lending mushroomed during the pandemic as a section of the population resorted to short-term emergency loans.

It was to meet their needs in the wake of the economic hardships brought on by Covid.

“While it has served the needs of various segments, it has also raised several concerns, which manifested itself through a spate of complaints regarding usurious interest rates, unethical recovery practices and data privacy issues,” Das said.

Das pointed out that the intention of the guidelines is not to penalise anybody or stifle any activity.

“All we are saying is follow the traffic rules,” he said.

The RBI had formed a working group on digital lending and it had come out with its recommendations in November last year.

The central bank in August 2022 came out with a press release, accepting several recommendations of the working group.

Many were accepted in principle, but they were not implemented as they needed further deliberations.

Earlier this month, RBI came out with detailed guidelines on the recommendations of the working group it had accepted for immediate implementation but gave the players three months’ time to transition.

“Everyone is not painted with the same brush.

“There are regulated entities and unregulated entities, so there is a clear distinction between the two.

“We have studied the entire sector and we have come out with ground rules.

“Based on the ground rules, if anyone has any difficulty, then he is welcome to come and discuss it with the RBI.

“First, we came out with a press release and then with the guidelines where we have given three months’ time for transition,” the RBI governor said.

“I wish to assure the fintech community that the RBI will continue to encourage and support innovation.

“At the same time, we would expect the ecosystem to pay attention to governance, business conduct, regulatory compliance and risk mitigation frameworks,” he said.

Lauding the rise in digital payments during the pandemic, Das said, the period from March 2020 to August 2022 has seen a massive growth of 427 per cent in UPI transactions.

They reached a new high of 6.57 billion transactions in August 2022 alone.

The number of UPI QR code-enabled payment acceptance points increased by about 90 million (up 86 per cent YoY) to reach 200 million at the end of July 2022.

This shows the growing acceptance and preference for contactless payments.

Meanwhile, the National Payments Corporation of India (NPCI) launched three products — RuPay Credit Cards on UPI, UPI Lite, and Bharat Bill Pay Cross Border Bill Payments.

The linking of RuPay credit cards to UPI was announced in the June monetary policy.

RuPay credit cards will be linked to a Virtual Payment Address (VPA), that is, UPI ID, thus directly enabling safe and secure payment transactions.

Initially, customers of Punjab National Bank, Union Bank of India, and Indian Bank will be able to use RuPay Credit Card on UPI with BHIM App.

As far as UPI Lite is concerned, the upper limit of a UPI Lite payment transaction will be Rs 200.

The total limit of UPI Lite balance for on-device wallet will be Rs 2,000 at any point in time.

Eight banks are live with this feature, including Canara Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of India, Union Bank and Utkarsh Small Finance Bank.

And, so far as Bharat BillPay Cross-Border Bill Payments is concerned, Federal Bank, with UAE’s Lulu Exchange, will be the first to go live on this.

Source: Read Full Article