Hi Nicole, are there any pathways to help people who are “working poor”? I.e. people who earn too much for a Centrelink payment or low-income health care card, and do not have the qualifying income support payments to access a release of super under financial hardship grounds? I am one of those, and the ever-increasing interest rates (extra $600 a fortnight and still climbing) as well as the increased costs of fuel and groceries are killing me. We are barely scraping through for groceries, bills are getting behind, there are mechanical repairs and dental costs, and debt is building up. I can’t possibly work any more – I already work full-time plus have a cash second job working nights and still barely make ends meet now. Thanks, Megan

Oh Megan, that’s just so tough. And to make things worse, 93 per cent of economists and experts think interest rates will go up again on Tuesday – though a small silver lining is that it will be only by 25 basis points.

However, it means that Aussie households could shortly be contending with 350 basis points of rate rises in less than a year.

For those materially struggling with the rapidly increasing cost of living, there are some ways to get help.Credit:Quentin Jones

The debt that you are now using to cope with these increases is likely an expensive credit card. See if you can’t freeze this immediately. The credit card application process is a lot more lenient than the mortgage one, so investigate a 0 per cent balance transfer if relevant.

You can pay no interest on a transferred balance for up to 36 months at present, which means that for three years you can park what you owe today, without seeing it grow. Simply pay the minimum without worry.

I will get to your big bills shortly – it sadly sounds like life is smashing you right now – but mitigating your mortgage cost is your next highest priority.

Mortgage applications are stress tested to see if you could cope with 300 basis points of rate hikes. For many people, the “fat” a lender was required to build into their finances is long gone.

And it seems, like many, you wouldn’t pass a fresh 3 per cent buffer test, a situation known colloquially as “mortgage prison”.

But you have already said the magic words: “financial hardship”. It may be the last thing that feels sensible, but go to the bank and tell them times are too tight.

The thing is: confessions are getting concessions. Indeed, they are legally obligated to somehow alleviate your pressure (so stop or reduce your repayments).

These financial hardship arrangements will also no longer hurt your credit score (a problem with repayment pauses during the pandemic) but will simply be noted on your credit file for one year.

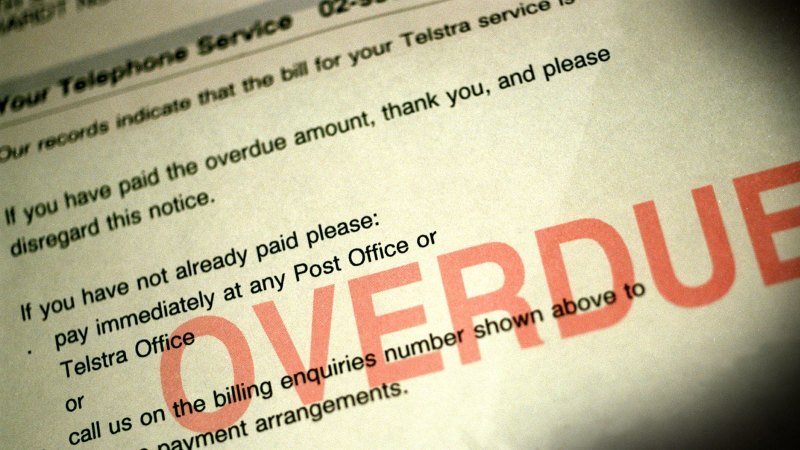

The next issue sounds like the inevitably ill-timed deluge of bills. The above asking-for-help approach works for regular bills too – these providers too must have a financial hardship department. See if you can’t put some on ice.

Then for large, unexpected expenses, there is a tremendous organisation called Good Shepherd Microfinance that can provide no- or low-interest loans to lower-income earners (up to $100,000 household income), particularly for health, motor vehicle or even education costs.

Repayments will be set at an amount you can afford.

This is what a financial counsellor will tell you. And you should go to one. Call the National Debt Helpline on 1800 007 007 and let these amazing individuals advise you and advocate for you.

- Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

The Money with Jess newsletter helps you budget, earn, invest and enjoy your money. Sign up to get it every Sunday.

Most Viewed in Money

From our partners

Source: Read Full Article