The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced a $508 million settlement agreement with London-headquartered British American Tobacco p.l.c. (BAT) to resolve its apparent violations of U.S. sanctions on North Korea and proliferators of weapons of mass destruction (WMD).

This settlement is OFAC’s largest ever with a non-financial institution and reflects the statutory maximum penalty.

OFAC’s investigation found that BAT, one of the world’s largest tobacco companies, engaged in a seven-year conspiracy from 2009 to 2016 to send over $250 million in profits from a North Korean joint venture through U.S. financial institutions by relying on designated North Korean banks and other intermediaries. BAT’s Singaporean subsidiary also exported tobacco to the North Korean Embassy in Singapore until 2017, using unwitting U.S. banks to receive or process these payments.

“Companies that seek to profit from circumventing sanctions by obscuring their involvement will be discovered and will pay a price,” said Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson. “For years, BAT partnered with North Korea to establish and operate a cigarette manufacturing business and relied on financial facilitators linked to North Korea’s weapons of mass destruction proliferation network in the process of enriching itself. Firms that deal with blocked persons, even indirectly, will be penalized when their schemes implicate the U.S. financial system,” he added.

OFAC said that BAT has agreed to pay $508,612,492 to settle its potential civil liability for apparent violations of OFAC’s sanctions against North Korea and WMD proliferators. In addition to confirming it had terminated the conduct in 2017, including the direct or indirect exportation of tobacco and tobacco products to North Korea, BAT agreed to significant compliance commitments and investments for the next five years consistent with OFAC’s 2019 Framework for Compliance Commitments.

BAT and its subsidiaries formed a scheme in 2007 to sell its stake in a joint venture formed in 2001 by British-American Tobacco Marketing (Singapore) PTE Ltd. and a North Korean Company to a Singaporean company, but still retain effective ownership and control over the Joint Venture.

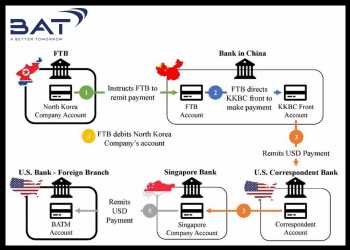

Between 2009 and 2016, the North Korea Company remitted Joint Venture profits, including payments owed to BATM, through a complex system that involved both OFAC-sanctioned Foreign Trade Bank (FTB) and Korea Kwangson Banking Corporation (KKBC). Even though BAT did not deal directly with FTB or KKBC, it exposed itself to liability when it formed and executed the broader scheme to use the U.S. financial system in furtherance of its Joint Venture-related business, OFAC said in a press release.

Source: Read Full Article