Robert Kiyosaki, renowned for his book “Rich Dad, Poor Dad” and vocal support for Bitcoin, has recently fine-tuned his price expectations for the flagship cryptocurrency. Previously anticipating a surge to $500,000 by 2025, Kiyosaki now sees Bitcoin’s next milestone at $135,000. This comes after Bitcoin’s recent impressive rally, experiencing a notable 15.81% surge within a few days, briefly breaching $34,500. As of the latest data, Bitcoin is trading at approximately $34,065. He is not only vocal about Bitcoin but also recent frauds, his love of gold and silver, and his evolving attitude toward crypto assets.

What Drew His Attention Towards Sam Bankman-Fried?

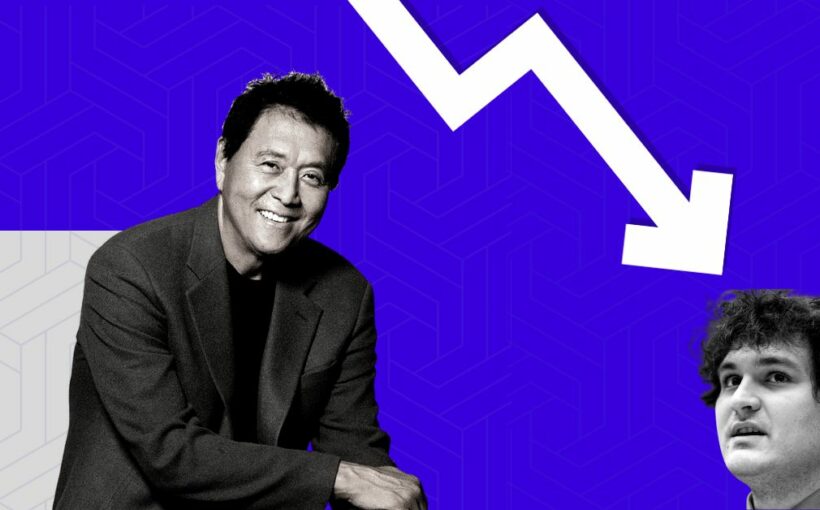

In a separate discussion, Kiyosaki expressed his concerns about Sam Bankman-Fried (SBF), the founder of the now-defunct crypto exchange FTX. Noting SBF’s success in garnering investments from high-profile figures like Jim Cramer and Kevin O’Leary, Kiyosaki questioned if SBF could evade legal repercussions in a manner the Federal Reserve and Treasury Secretary are fooling everyone.

Kiyosaki doesn’t mince words regarding the US government’s relentless money printing over the past three years, ignited by the pandemic. He passionately implores his audience to snap out of their financial slumber, boldly questioning if we’re sailing on a ship of fools, seemingly blind to the financial turmoil caused by the government injustice. It’s a wake-up call to get financially savvy and demand accountability.

Kiyosaki’s Affordable Bets!

Kiyosaki, in his discussion, didn’t forget his age-old love for assets like gold, silver, and Bitcoin as affordable investments accessible to average individuals. He built a castle while accumulating these assets over time, pinpointing the power of dollar-cost averaging in building wealth. Kiyosaki has consistently supported these assets as long-term holds, citing his personal experience of purchasing a gold coin for $50, which has since appreciated to $2,000.

Bitcoin in Comparison with Gold

Bitcoin and Gold have seen price surges due to their status as safe-haven assets amid the Middle East crisis. Gold has been performing well in the commodities market, while Bitcoin Dominance is approaching 53% for the first time since 2021. The ongoing situation in the Middle East may continue to drive up the prices of both assets during economic uncertainty. Since Gold got the surge after Gold ETFs rolled into the market, making it a hot choice on a similar note, Spot Bitcoin ETF is also expedited to bring a multi-layer surge in Bitcoin prices.

Source: Read Full Article