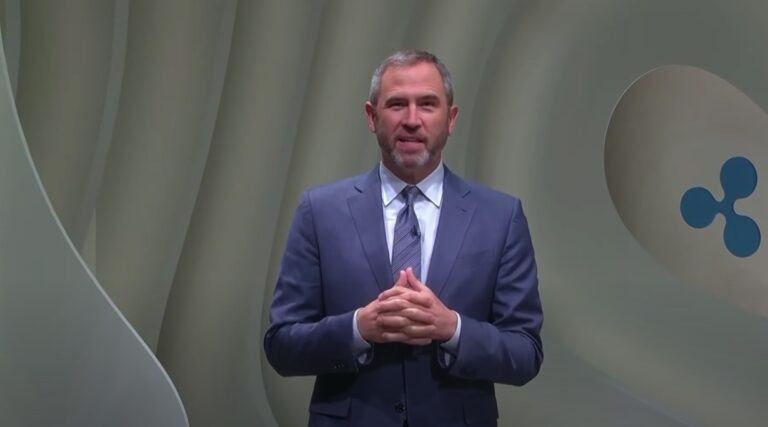

As reported by Bloomberg, Brad Garlinghouse, the CEO of Ripple, has indicated the company’s readiness to take its legal battle with the U.S. Securities and Exchange Commission (SEC) over the XRP cryptocurrency to the Supreme Court. This statement emerged during Garlinghouse’s interview with Bloomberg Television’s Kailey Leinz at the DC Fintech Week event (November 6-8, 2023).

Bloomberg notes that Ripple has incurred over $150 million in legal expenses since the SEC filed a lawsuit against the company in 2020. The SEC alleges that Ripple’s method of raising funds through the sale of XRP tokens was executed without the necessary registration as securities.

The legal conflict has attracted considerable attention in the cryptocurrency community, primarily for its potential implications on the SEC’s regulatory authority over digital assets. Bloomberg highlights a significant development in July when a federal judge ruled that XRP sales to retail investors on exchanges did not constitute investment contracts, a decision seen as a limitation to the SEC’s jurisdiction.

According to Bloomberg, Garlinghouse emphasized Ripple’s determination to continue the legal fight, though he did not exclude the possibility of settling the case in the future.

Here is what Garlinghouse told Bloomberg about the possibility of the case reaching the U.S. Supreme Court:

“We’d love to see the Vegas odds on how that would go. We are in it until the end.“

The SEC has recently sought to dismiss parts of its lawsuit against Ripple’s co-founders, including Garlinghouse, but may appeal the judge’s July ruling.

Bloomberg reports that the SEC uses a precedent from a 1946 Supreme Court case to determine if an asset falls under its securities regulations. However, crypto advocates argue that many digital assets do not meet this criterion and call for the SEC or Congress to introduce revised regulations that reflect the unique characteristics of cryptocurrencies.

During a separate panel at the DC Fintech Week event, SEC Chair Gary Gensler, as reported by Bloomberg, expressed pride in the agency’s enforcement actions in the crypto sector. He emphasized the consistency of court rulings that support the SEC’s approach, highlighting the importance of providing disclosures to investors.

On November 8, RocketFuel, Inc., a global payments processing company, announced that it had formed a strategic partnership with Ripple. This collaboration is set to enhance RocketFuel’s transactional infrastructure by integrating Ripple’s advanced payment technology, particularly for fiat currency transfers to international merchants and partners.

RocketFuel’s platform offers a one-click checkout system supporting various payment methods, including major cryptocurrencies and traditional bank transfers. The company emphasizes user security and privacy, ensuring its technology not only streamlines the user experience but also safeguards against data breaches.

This partnership enables RocketFuel customers to enjoy simplified checkout processes, fostering impulse buying. Merchants, in turn, benefit from new sales channels and potential revenue growth through RocketFuel’s comprehensive services, including pay-ins, payouts, B2B cross-border payments, and invoicing solutions.

RocketFuel CEO Peter Jensen participated in Ripple’s Swell conference in Dubai this week, where he discussed the evolving payments industry, the growing importance of cryptocurrencies, and the transformative potential of Ripple’s technology in current payment processes.

Source: Read Full Article