With Bitcoin experiencing a sharp drop as the deadline for a potential blockchain split nears, investors are smart to wonder how this move is affecting the value of competing cryptocurrencies. These currencies are not currently experiencing the technological challenges (and community discord) of Bitcoin, but they are nonetheless volatile as their future depends on how the current Bitcoin crisis is resolved.

A simple assumption is that competing cryptocurrencies should benefit from Bitcoin’s current identity crisis. Savvy investors may choose to exchange their Bitcoins for Ethereum or Litecoin until the matter is resolved. If Bitcoin hard forks on August 1st, and does not right itself, The value of these currencies may jump as the world of Bitcoin descends into chaos. Many investors assume, logically, that a new cryptocurrency could emerge as the new favorite. To see what may happen, a closer look at the current prices, and historic trends, is necessary.

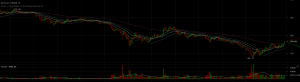

If investors were moving from Bitcoin to other cryptocurrencies, the prices of lesser coins would clearly be increasing. However, as Bitcoin has slid, so have its competitors. Ethereum, Bitcoin’s current top rival, has experienced an even bigger drop in value than Bitcoin over the last several days. Ethereum dropped below $150 on Sunday, down from over $275 at the beginning of this month. It has recovered slightly, but it is clear that those currently abandoning Bitcoin are not putting their trust in ETH.

Litecoin, on the other hand, has hovered between $40-$50 for most of the Summer. Litecoin’s biggest boost came earlier this year shortly before it adopted its own version of SegWit, after which it retreated sharply. Despite a brief surge in the past two weeks, Litecoin is also seeing its value slip downward. Although one can argue that Litecoin has been the safest of the major coins this year, it is clearly not benefitting from Bitcoin’s current turmoil.

Other cryptos, such as Ripple and Dash, are seeing similar declines. Thus, perhaps it is safe to assume that the current sell-off is part of an overall market correction, and not a direct response to the impending Bitcoin upgrade deadline. This is not to say that the impending deadline is insignificant. Rather, the first half of this year saw a cryptocurrency bubble emerge, which was bound to deflate sooner or later. A similar situation occurred in late 2013 when a Chinese regulation against Bitcoin put the brakes on the currency’s explosive rise to over $1,100.

The current state of affairs indicates that cryptocurrencies have become linked in the minds of investors and users. They rise and fall together. Bitcoin’s growing pains are felt across all its competitors. This also has a historic precedent. In 2013, Litecoin rose in value even faster than Bitcoin. It, too, plummeted when that bubble burst.

As nobody knows yet what will happen on August 1st, it is safe to assume that price volatility will continue. Should a Bitcoin hard fork be avoided, a likely scenario will be a price resurgence. Bear in mind that scores of trading accounts will be flush with fiat value from the current sell-off, and these investors will want back in the game. This will benefit all cryptos. Should the hard fork happen, the ensuing chaos will probably have a similar impact on them all as well.

Source: Read Full Article