On Monday (October 3), gold bug Peter Schiff said that instead of going after Kim Kardashian, the U.S Securities and Exchange Commission (“SEC”) should have charged “the real pumpers” like MicroStrategy Co-Founder and Executive Chairman Michael Saylor.

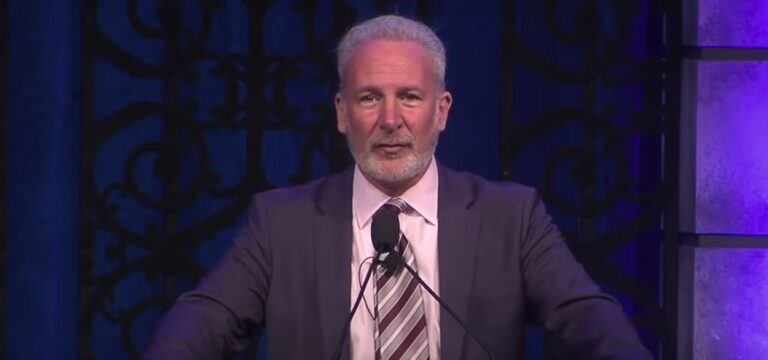

Bitcoin perma-bear Peter Schiff, who is one of Bitcoin’s harshest critics, is the CEO of Euro Pacific Capital, a full-service, registered broker/dealer specializing in foreign markets and securities. He is also Founder and Chairman of SchiffGold, a full-service, discount precious metals dealer.

Schiff’s comments were made following yesterday’s announcement by the SEC that it had brought charges against American media personality and entrepreneur Kim Kardashian for alleged promotion of cryptoasset $EMAX.

The SEC’s press release stated that these charges were “for touting on social media a crypto asset security offered and sold by EthereumMax without disclosing the payment she received for the promotion” and that she had “agreed to settle the charges, pay $1.26 million in penalties, disgorgement, and interest, and cooperate with the Commission’s ongoing investigation.”

The press release went on to mention that its order “finds that Kardashian failed to disclose that she was paid $250,000 to publish a post on her Instagram account about EMAX tokens, the crypto asset security being offered by EthereumMax” and that “Kardashian’s post contained a link to the EthereumMax website, which provided instructions for potential investors to purchase EMAX tokens.”

And Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, stated:

“The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion. Investors are entitled to know whether the publicity of a security is unbiased, and Ms. Kardashian failed to disclose this information.“

The SEC also said that “without admitting or denying the SEC’s findings, Kardashian agreed to pay the aforementioned $1.26 million, including approximately $260,000 in disgorgement, which represents her promotional payment, plus prejudgment interest, and a $1,000,000 penalty.” Apparently, she also “agreed to not promote any crypto asset securities for three years.”

Before looking more closely at what Schiff said yesterday, it is worth saying a few words about Michael Saylor and his Nasdaq-listed software company MicroStrategy Inc.

On 11 August 2020, MicroStrategy announced via a press release that it had “purchased 21,454 bitcoins at an aggregate purchase price of $250 million” to use as a “primary treasury reserve asset.”

Saylor said at the time:

“Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively.“

Since then MicroStrategy has continued to accumulate Bitcoin and its former CEO has become one of Bitcoin’s most vocal advocates. MicroStrategy’s latest $BTC purchase, which Saylor tweeted about on 20 September 2022, means that the firm is now HODLing around 130,000 bitcoins, which were “acquired for ~$3.98 billion at an average price of ~$30,639 per bitcoin.”

This move by the SEC to charge Kardashian led Schiff to send out a tweet in which he said that the SEC should be people like Saylor who “had much more to gain pumping crypto than Kim.” Saylor then replied to Schiff to point out that he has not violated any U.S. securities laws since Bitcoin is recognized by the SEC as a commodity (like silver and gold) and not a security.

As you can see from the tweet below, which was sent out by Saylor on 27 June 2077, SEC Chair Gary Gensler, just like his predecessor Jay Clayton, has confirmed on more than once occasion that the SEC views Bitcoin as a commodity.

Source: Read Full Article