However, withdrawing stETH was impossible and required another technological upgrade – Shapella.

The tokens also make up over 13% of ETH’s total token supply. Entities have locked ETH a staggering amount of ETH since 2020 to secure their place as Ethereum validators – the people who help manage ETH’s network by authenticating transactions and securing the chain.

Ethereum Validators And Centralization

These validators became a crucial part of Ethereum after the Merge, effectively replacing miners who operate similar duties in a PoW blockchain. While the growing number of validators beyond 500,000 and stETH exceeding 16 million tokens could indicate increased interest in ETH, the coming unlock also raises concerns of sell pressure in the market.

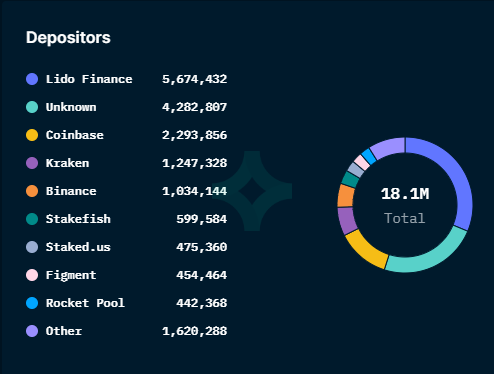

The concentration of stETH in the hands of a few entities also might pose centralization concerns. Indeed, Nansen data shows that services like Lido Finance, Coinbase, Kraken, and Binance are the top five staked ETH depositors.

Source: Read Full Article