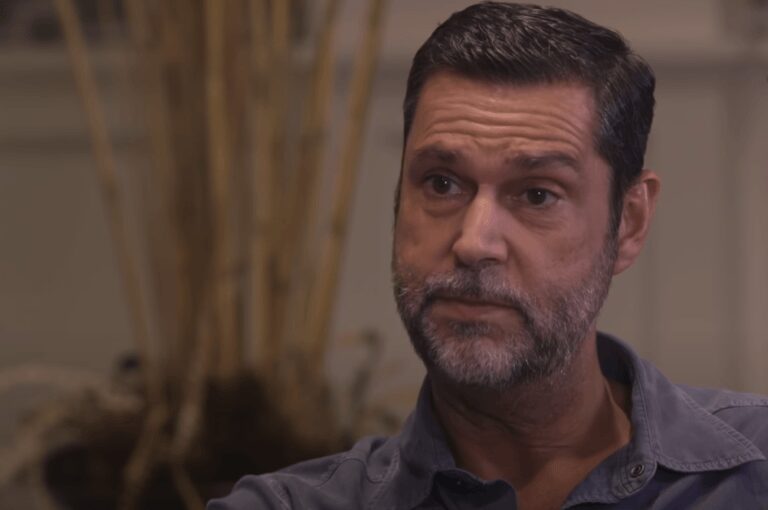

In a recent interview, former Goldman Sachs executive Raoul Pal talked about $ETH, the native token of the Ethereum blockchain, and how its price action could affect the native tokens of other layer one (L1) blockchains (such as Solana, Terra, Avalanche, and Cardano).

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

His comments about the crypto market were made on October 28 during an interview he did with Ash Bennington, Senior Editor for Real Vision.

According to a report by The Daily Hodl, Pal, who has been getting more and more bullish on Ethereum since October 2020 (when he came to the realization that $ETH would probably be outperforming $BTC over the next couple of years), said that he could envision $ETH’s bull run extending to Q2 2020, and that if this prediction comes true, he would expect altcoins that are native tokens of other popular L1 blockchains to make even bigger gains than $ETH (though as usual, with higher reward comes higher risk):

“I think almost certainly till March but possibly to the summer, which will give us higher prices and a different cycle structure than we’ve seen before. I could be wrong. I’m not betting the entire ranch on it. But that’s how I think it plays out. And if I’m right about the network adoption, then these other layer-1s like Solana, Terra, Avalanche, Cardano, and some of the others are going to be super explosive...

“But in a risk-reward basis, they’re riskier. They’re not as deep a network as Ethereum is. Ethereum to me remains the best bet in the world from a risk-adjusted standpoint.“

As for when the current bull ran will come to an end, he expects this to happen once Ethereum’s market cap surpasses Bitcoin’s market cap since that would shock the crypto market, which in turn could cause a correction:

“My guess is it gets pretty close to Bitcoin’s market cap. So, I think it probably in the end somewhere doubles in relative valuation versus Bitcoin. I don’t think the market quite expects that. But maybe that short period of the flippening would be the end of the cycle, when everybody punches the air, all the Bitcoin guys get pissed off because Ethereum outperformed, then we get a larger correction.“

On October 29, Pal, who is currently “irresponsibly long” on $ETH (with around 85% f his personal investment portfolio in $ETH), had another interview with Bennington, during which he explained that one of the major reasons for his bullishness on $ETH is the scarcity of its supply relative to demand.

According to The Daily Hodl, Pal had this to say about Ethereum’s free float:

“[Ethereum] has a restricted supply because of the burning of ETH from the gas fees. Everybody’s staking their tokens for ETH 2.0, so you’ve taken loads off the exchange. Then there… [is] about $100 billion locked up in DeFi (decentralized finance), NFTs (non-fungible tokens) and all of that. That actually leaves a free float of Ethereum of about 11%.

“11% is all the available Ethereum that you could buy if you went into the marketplace, and we’ve got that demand shock going on in front of our eyes. Bitcoin has nothing like that going on. Yes, there is a supply shock, yes, there’s a bit of a demand shock, but it just doesn’t have the network intensity that Ethereum does.“

https://youtube.com/watch?v=YI6wnYGElpo%3Fstart%3D2%26feature%3Doembed

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Source: Read Full Article