In a recent LinkedIn post, Jurrien Timmer, the Director of Global Macro at Fidelity Investments, offered an insightful analysis of the role of Bitcoin and gold as potential stores of value in investment portfolios. His observations are particularly relevant in the context of modern portfolio management strategies.

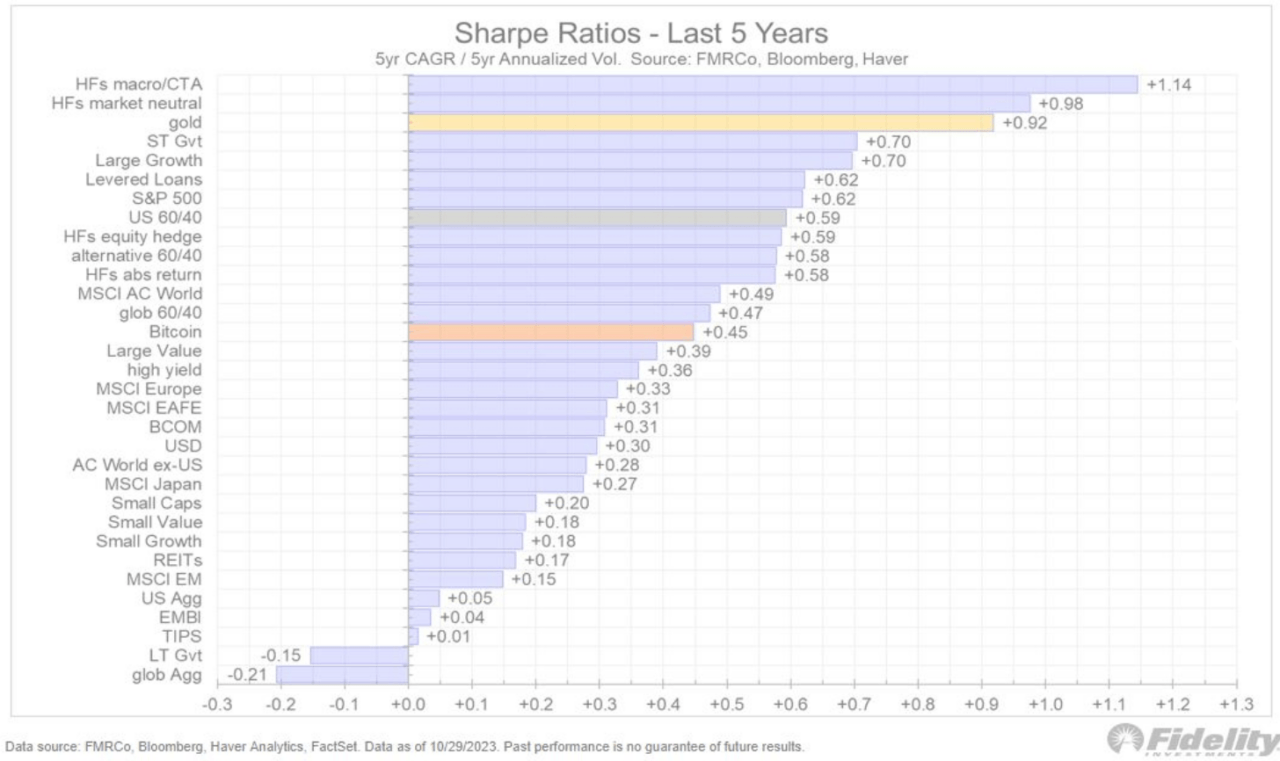

Gold’s Consistent Performance and Sharpe Ratio: Timmer highlights gold’s strong risk-adjusted returns, evidenced by its impressive Sharpe Ratio over a five-year period. The Sharpe Ratio, a measure of risk-adjusted return, indicates that gold has been a reliable and stable investment, outperforming many other assets in terms of both return and volatility.

Bitcoin’s Position and Correlation: In comparison, Bitcoin, while respectable, shows a different risk-return profile. It exhibits a positive correlation with equities, although less pronounced than other assets. This correlation is significant in understanding Bitcoin’s behavior in diverse market conditions.

Bitcoin in a 60/40 Portfolio: Timmer suggests that Bitcoin fits well in the ‘alts’ (alternatives) category of a traditional 60/40 portfolio (60% stocks, 40% bonds). He notes that Bitcoin’s correlation is becoming less positive against the S&P 500 and exhibits a negative correlation to the US Dollar and T-Bills. Interestingly, Bitcoin remains uncorrelated with gold, challenging the notion that they serve similar functions in a portfolio.

Comparative Analysis of Sharpe Ratios: A critical observation is the convergence of the Sharpe Ratios of Bitcoin and gold. While gold has been a consistent performer, Bitcoin’s ratio indicates a maturation in its market behavior despite its historically volatile nature.

Volatility Comparison and Portfolio Allocation: Timmer points out that Bitcoin’s volatility is approximately four times that of gold. By hypothetically quadrupling the position in gold to equate to that of Bitcoin, the return profiles over the past five years align closely. This analysis provides a basis for considering portfolio allocations in terms of risk and return equivalence.

Proposed Allocation in an Alt-60/40 Portfolio: Given these dynamics, Timmer proposes a potential allocation strategy. For a 5% ‘store of value’ position in an alternative 60/40 portfolio, a combination of 2% in gold and 1% in Bitcoin could effectively equate to a 6% position, balancing risk and return considerations.

On November 1, Timmer shared his thoughts on cryptocurrency’s future on the social media platform X, previously known as Twitter. His commentary revisited ideas he initially proposed in late 2020.

Timmer’s analysis started with an examination of Bitcoin’s current trajectory, characterized by its historical pattern of highs and lows. He engaged his followers by questioning the implications of this recurring trend.

In his detailed analysis, Timmer characterized Bitcoin as a “commodity currency” aspiring to be a recognized store of value, offering a hedge against monetary debasement. He compared Bitcoin to “exponential gold,” noting that while gold is a form of money, its practical limitations restrict its use as a medium of exchange. For investors, gold primarily serves as a store of value, a role often paralleled with Bitcoin.

Timmer then provided a historical backdrop, observing that gold thrives in economic situations marked by high inflation, negative real interest rates, and excessive money supply growth. He highlighted the 1970s and the 2000s as periods when gold significantly outperformed, capturing a greater market share relative to global GDP.

At the Robin Hood Investors Conference, sponsored by J.P. Morgan on October 24-25 in New York City, a discussion between billionaire hedge fund manager Paul Tudor Jones II and renowned investor Stanley Druckenmiller, who manages his wealth through Duquesne Family Office LLC, drew significant attention, especially from the cryptocurrency community.

Druckenmiller shared his concerns about potential economic disruptions in the U.S., hinting at stock market involvement as early as 2024. He noted recent signs of an economic downturn based on his observations over the past five weeks.

Discussing the stock market, he spoke about the Biden Administration’s economic stimulus measures, acknowledging their potential investment opportunities but also warning of the pressure they might put on interest rates and the possibility of market disruptions.

On Bitcoin, Druckenmiller recognized its increasing acceptance as a store of value, particularly among younger investors, and expressed regret over not investing earlier. While he doesn’t currently hold Bitcoin, he acknowledged its transactional advantages over gold, which he owns. He noted that both assets are seen as stores of value, but Bitcoin’s ease of use makes it more appealing to the younger generation.

https://youtube.com/watch?v=dmrrt7aCXhY%3Ffeature%3Doembed

Featured Image via Pixabay

Source: Read Full Article