Bitcoin Miners are Choosing to Hodl Their BTC

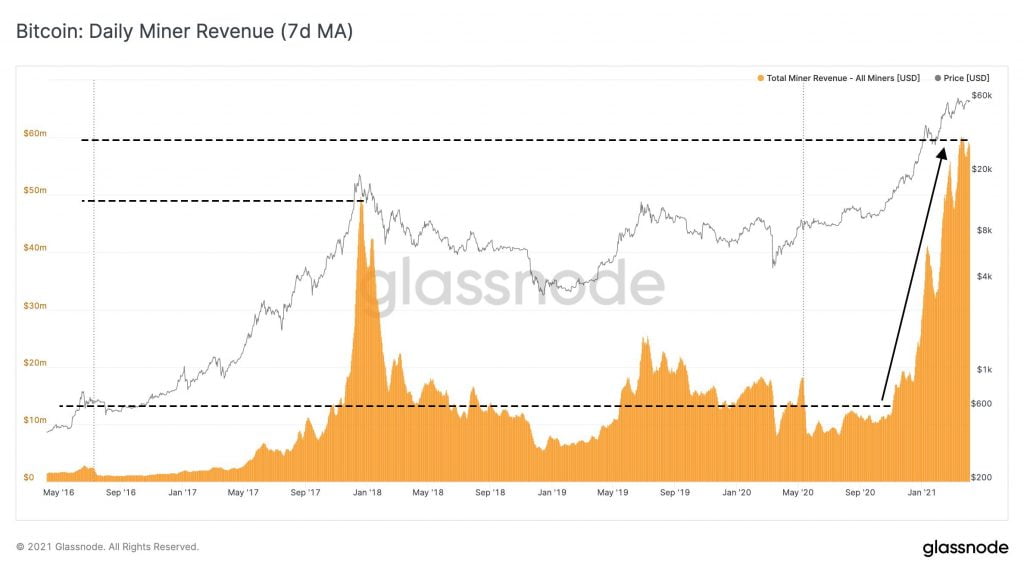

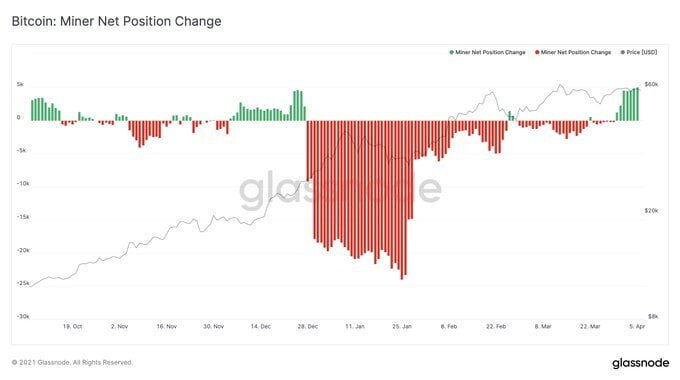

Mr. Schultze-Kraft went on to point out that Bitcoin miners are no longer selling much of their newly minted BTC and are instead opting to hodl. He pointed out that a lot of miners sold their BTC during the rise towards $40k but it seems this pattern has changed as illustrated through the following chart which he shared.

Bitcoin Miner Metrics Point towards More BTC Price Growth

To conclude his analysis, Mr. Schultze-Kraft stated that the miner metrics are particularly bullish for Bitcoin’s long-term price growth since there was not much data indicating miner capitulation.

I see strong Bitcoin miner metrics. Great fundamentals, bullish long-term – selling or capitulation not in sight. Imo miners have little to no incentives to be cashing out now and have other means to cover capex and opex (e.g. borrowing).

Review of Bitcoin’s Short Term Price Movement

At the time of writing, Bitcoin is trading at $56,500 after yesterday’s dip to a local low of $55,473 – Binance rate. The latter price level is now acting as short-term support that could assist Bitcoin in printing a double bottom pattern in the hours to follow. However, if $55,473 fails to hold, Bitcoin could be headed towards another strong support zone at $55k.

Source: Read Full Article