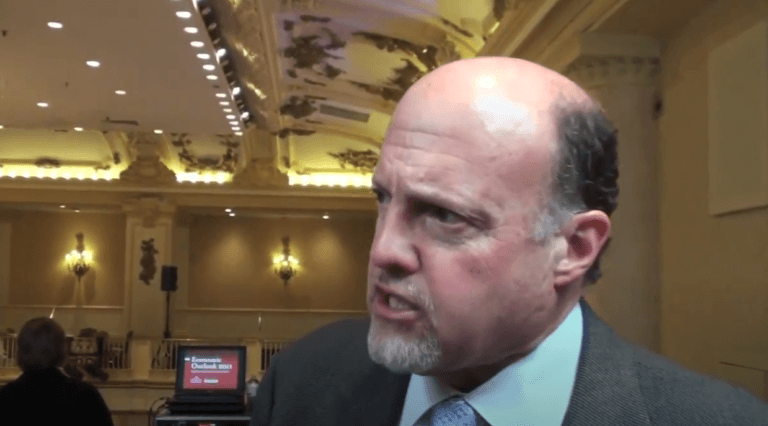

Former hedge fund manager Jim Cramer recently explained why he believes that it is currently safer to invest in Ethereum than Bitcoin.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

On Monday (June 21), Cramer said on CNBC’s “Squawk on the Street”:

“Tom DeMark, who’s been the best, is saying… it’s got to hold $30,000, but there’s two headwinds, and one is I just think that when the PRC goes after something, they tend to have their way…. but then I keep thinking about the FBI and ransomware and what happened with Colonial [Pipeline].

“We know [about] Colonial. How many have we not found out [aboiut]? We know that then people must be paying ransomware. So how about if the FBI goes to see the IRS and goes to the Justice Department [and] says ‘we can’t control this, then they refer to the Federal Reserve. Federal Reserve doesn’t want Bitcoin. Then they decide… no more ransomware…

“Instead of thinking that Bitcoin should go up if it’s outlawed or if it’s made tougher to be mined, Bitcoin goes down as if people are saying I gotta redeem… How else could it be going down?… It should obviously go up unless there is a worldwide redemption… and Tether is deeply involved… and they have not really told us what kind of commercial paper backs them and yet they are one of the largest buyers and yet I can’t find anyone, any desk, that does business with them.

“So I’ve got the Tether weak link. I got what the heck was going on that this thing’s going down if it can’t be mined and I’ve got the possibility that Colonial isn’t the only ransomware. I’m saying that this is not going up because of structural reasons. And I know Tom DeMark… says ‘$30,000 intraday, look out, gotta hold, may be the buy point’… I’m not going there. Sold almost all my Bitcoin. Don’t need it.“

The next day (i.e. June 22), Cramer told Katherine Ross (a correspondent for TheStreet):

“I’m moving much more into Ethereum. I think that Bitcoin is much more front and center an issue in China and I just want to avoid anything that is on the other side of the PRC. I have not been very positive on the actions of the PRC, obviously, but I do think the people of China are terrific.

“I just feel like that the government is in crackdown mode and they don’t want billionaires who really are the centers of the price of Bitcoin — American billionaires — they don’t want them running [an] alternative currency. So, I totally understand that Chinese governments view and I just don’t want to run foul.“

He went on to talk about why he is not in the mood to get back into Bitcoin despite the recent rebound:

“I fear the Chinese government. I they stopped crackdown, I would probably go in, but I think the Chinese government has spoken and says they don’t like Bitcoin. So I’m sticking with Ethereum. They don’t seem to be attacking Ethereum right now… I just feel that Ethereum could escape the clutches of China… If Bitcoin came down more and China changed its status, that would be different.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Source: Read Full Article