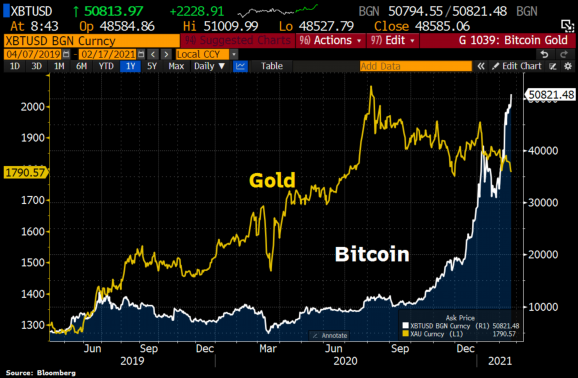

Wall Street is abuzz with a chart comparing the performance of bitcoin and gold over the past two years.

Gold was rising until March 2020 with bitcoin not moving. Gold then peaks in August and starts falling, while bitcoin takes off.

This shows bitcoin is an uncorrelated store of value, but some speculate bitcoin is replacing gold’s role as a safe haven asset.

That’s because bitcoin is perceived to have responded a lot better to the economic shocks of 2020.

While a $1.9 trillion stimulus is on its way, for example, gold is falling in price. Bitcoin on the other hand is rising as a safe haven asset and a hedge is meant to do.

That’s in part potentially because a lot of gold holders are moving to bitcoin, with billions taken off gold ETFs that have probably made their way to bitcoin.

One reason may be because bitcoin is a lot more global and accessible. For Americans and Europeans, buying a gold ETF can be relatively easy, but someone in Africa has little chance of doing so.

Thus when inflation began nearing galloping levels in Nigeria, they turned to bitcoin which has a far bigger infrastructure than gold as digital bitcoin exchanges exist in pretty much every country.

For the same reason bitcoin is likely to respond far quicker and at an appropriate level to geopolitical shocks to the point a study called bitcoin even a predictor of geopolitical risks.

As bitcoin is far easier to acquire in a bearer asset manner and as it is extremely easy to transport to the point you can just memorize it, the currency may well be growing to become the go to asset if banks are down as recently in Myanmar for example.

These advantages could well be a cause of concern to some gold holders as they may well need to consider the risk of their key function being disrupted by the digital revolution.

Gold is far bigger currently, with its supply unknown but some estimate its market cap to be about $20 trillion.

All of it is unlikely to evaporate any time soon, but if it is correct that people around the world now turn to bitcoin just because it is far more accessible, then presumably a lot of the value stored in gold will move to bitcoin.

Hence this chart exemplifying that potentially historic shift, with the world of finance currently at the brink of a cultural transformation.

Source: Read Full Article