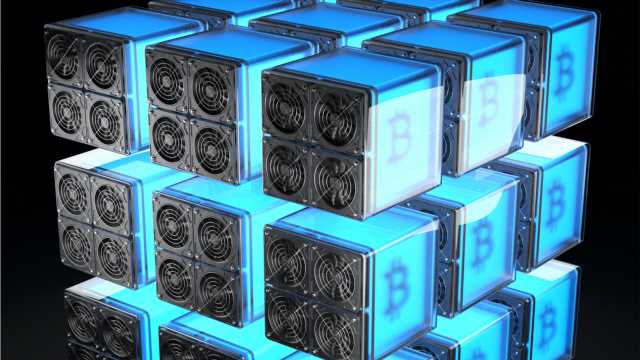

On January 11, 2022, the Washington-based bitcoin mining operation Luxor announced the launch of a new application-specific integrated circuit (ASIC) trading desk. According to the company, Luxor’s new trading desk will give miners and investors access to bitcoin ASIC mining rigs “at a fair market price.”

NYDIG-Backed Mining Operation Luxor Reveals ASIC Trading Desk Service

The bitcoin mining firm Luxor aims to purchase and sell bitcoin mining machines via the company’s new ASIC trading desk service. The press release published on Luxor’s web portal explains that the company “will purchase and sell specialized Bitcoin mining hardware on behalf of the Luxor team, miners and investors.” Luxor recently raised $5 million in a Series A led by the firm NYDIG in June 2021.

Furthermore, the Luxor mining pool is the 12th largest mining pool at the time of writing on Wednesday, with 0.46 % of the global hashrate or 801.30 petahash per second (PH/s). Luxor’s ASIC trading desk announcement details that the company is confident in its equipment procuring process.

“After moving tens of thousands of machines and serving miners across a few continents, we established a streamlined process for procuring equipment. Our multinational team has a deep network of ASIC manufacturers, re-sellers, miners, and investors,” Lauren Lin, Luxor’s operations manager remarked during the announcement.

The move to establish a mining rig trading desk follows Foundry’s mining machine marketplace announcement last December. The market is called Foundryx and the firm’s announcement claimed at the time that it had 40,000 mining machines ready for resale. During the first week of June 2021, Canaan revealed the company has established an overseas after-sales center in Kazakhstan.

Luxor says the firm will take “principal positions in ASICs to help miners gain access to rigs at fair market prices. “Our ASIC Trading Desk is an important step on our roadmap to becoming a full-scope mining services firm,” Alex Brammer Luxor’s VP of business development explained. Brammer added:

Whether it’s an institutional miner replacing a fleet of new-generation machines or retail buying one rig, we are able to maximize our clients’ capital efficiency and minimize their risk. Our goal is to simplify the procurement process so our miners can spend more time building hashrate and less time worrying about how to find it.

Source: Read Full Article