Singapore will continue to prioritise developing local workers as the financial services sector expands, said Manpower Minister Josephine Teo yesterday.

She said this will allow Singaporeans to deepen their expertise and access new opportunities while Singapore-based firms expand alongside a growing talent pool.

Around 1,300 local workers were employed by 400 financial sector employers last September, based on preliminary estimates, she said.

These employers will receive substantial support through the Jobs Growth Incentive, a billion-dollar scheme that helps workers shift from businesses that were downsizing, owing to the pandemic, to sectors that are continuing to expand.

Local workers have accounted for about 80 per cent of those employed in the financial sector over the past five years.

“We are mindful that considerable uncertainties remain. The Government and our industry partners will adopt a three-pronged approach to enhance Singapore’s position as a trusted location of choice for financial institutions,” said Mrs Teo, who was speaking at the Institute of Banking and Finance Singapore (IBF) Awards 2020.

She said they would double down on efforts to further digitalise financial services. “This is irreversible, and the sooner we get to it, the faster we move, the better it is.

“This will enable the sector to meet increased demands for more varied digital finance solutions and better user experiences.”

Singapore will also boost the connectivity of its businesses with overseas players to broaden their opportunities.

The third pillar involves helping firms seize new opportunities in areas such as green and pandemic risk financing and insolvency.

Past crises have shown that adaptable companies are far more likely to succeed, said Mrs Teo. “This goes hand in hand with a workforce that is agile, and which takes reskilling and upskilling in its stride.”

This is irreversible, and the sooner we get to it, the faster we move, the better it is. This will enable the sector to meet increased demands for more varied digital finance solutions and better user experiences.

Financial institutions can bridge skills gaps by hiring and training mid-career job seekers who bring valuable experience, she said.

Many are already on board with professional conversion programmes (PCP) and have committed to reskill and redeploy 5,300 staff in areas such as consumer banking and operations. About 1,900 of these workers have completed their training and been redeployed into new or enhanced roles.

Companies can also tap the Technology in Finance Immersion Programme to train mid-career job seekers in key areas such as cloud computing and cyber security.

Finance professionals were lauded yesterday for their efforts to develop the sector at the awards ceremony, which was live-streamed from Sofitel Singapore City Centre.

The IBF Inspire Award honouring firms that have embraced skills development and helped employees stay relevant went to DBS Bank, Great Eastern Singapore, Prudential Singapore and UOB.

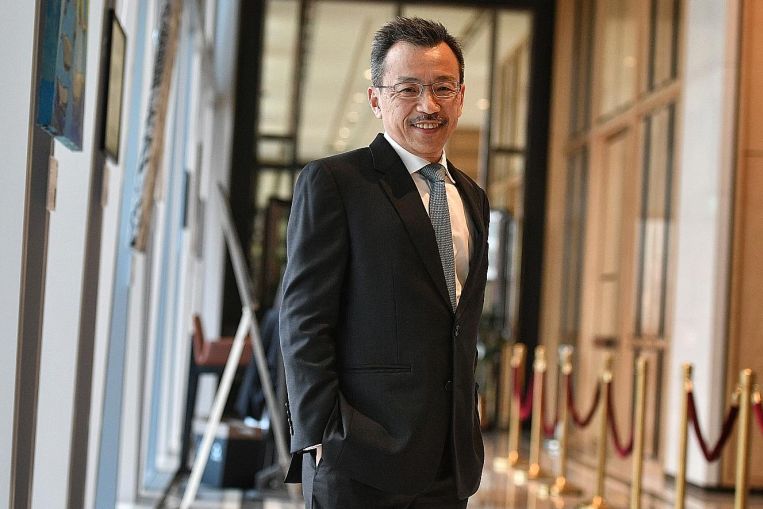

Mr Lim Khiang Tong, head of group operations and technology at OCBC Bank, and Ms Mabel Ha, who holds senior advisory roles in the industry, received the IBF Distinguished Fellow award, which recognises leaders who have championed change.

Mr Lim told The Straits Times that 30 per cent of OCBC’s operations staff have started their PCP training in areas such as machine learning and data science. “Professionals should look at how their roles are likely to change dramatically in the next few years and look towards reskilling and upskilling.”

Meanwhile, 19 professionals received the IBF Fellow award, which recognises those who have shown mastery of their profession, thought leadership and commitment to industry development.

One of them, Mr Jon Yeo, Maybank Singapore’s chief compliance officer, started an internship scheme in 2016 to groom undergraduates and postgraduates interested in careers in compliance.

He said: “People often think compliance is narrowly scoped to anti-money laundering. But we also manage personal data protection, insider trading risk and other regulatory risks.

“Understanding the wide spectrum of regulations… opens up a lot of opportunities for job seekers.”

Join ST’s Telegram channel here and get the latest breaking news delivered to you.

Source: Read Full Article