Medical imaging, which is also referred to as diagnostic imaging, involves the utilization of electromagnetic radiation and other techniques to provide insight into the body’s internal structures, assisting in identifying the root cause of an ailment or injury and validating a diagnosis.

According to a report by the market research firm IndustryARC, the global Diagnostic Imaging Services Market is expected to experience a compound annual growth rate (CAGR) of 5.1% during the forecast period of 2022-2027, with an estimated market size of $732 billion by 2027.

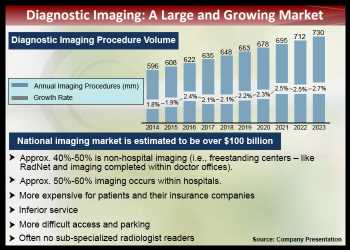

The company we are profiling today is one of the key players in the Diagnostic Imaging Services Market – RadNet Inc. (RDNT).

RadNet is a provider of fixed-site outpatient diagnostic imaging services through a network of 357 owned and/or operated outpatient imaging centers. The company has also made significant investments in Artificial Intelligence solutions through three AI acquisitions namely DeepHealth (acquired in Apr.2020), Aidence (Jan.2022) and Quantib (Jan.2022).

The AI segment aims to explore opportunities in cancer screening, with a focus on the four most prevalent cancers of Breast, Prostate, Lung and Colon.

A review of the company’s balance sheet over the past four years indicates that revenue has grown consistently year after year with the exception in 2020.

Total revenue was $1,154 million in 2019; $1.072 million in 2020; $1,315 million in 2021; and $1,430 million in 2022.

The company ended the year 2022 with a cash balance of over $127 million.

Monetizing AI investments

As part of its initiative to convert AI investments into profitable ventures, the company began an implementation of its Enhanced Breast Cancer Diagnostic (EBCD) mammography program last November.

Under the EBCD program, RadNet is offering novel AI-enhanced mammography services to women in conjunction with its annual breast cancer screening exams for an additional fee.

The Enhanced Breast Cancer Diagnostic mammography program is expected to be available in all RadNet mammography centers by the end of summer 2023.

RadNet anticipates expanding its current health system joint ventures and partnerships, as well as establishing new ones, throughout 2023.

Looking Ahead

The company expects a robust performance in 2023, with improvements projected across all financial and operating metrics.

For 2023, the Imaging Center Segment is projected to generate revenue between $1,525 million and $1,575 million, while the Artificial Intelligence Segment is expected to bring in $16 million to $18 million in revenue. In comparison, the Imaging Center Segment revenue was $1,426 million and Artificial Intelligence Segment revenue was $4.4 million in 2022.

RDNT has traded in a range of $12.03 to $24.41 in the last 1 year. The stock closed Tuesday’s trading at $23.58, up 12.04%.

Source: Read Full Article