This Morning: Martin Lewis explains the energy price cap

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

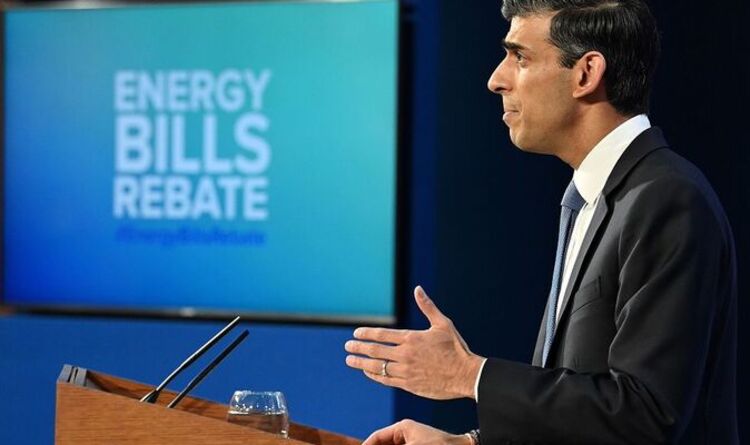

From April 1, Ofgem’s energy price cap will see a typical household’s bills rise to £1,971. “It is the biggest annual increase in core fuel that we’ve seen really,” said Nigel Pocklington, chief executive of energy firm Good Energy, who described it as an “unprecedented shock”. Last week, all eyes turned to Chancellor Mr Sunak for new measures to address the cost of living crisis in the Spring Statemen. But few further announcements have been offered beyond the previously revealed rebate scheme.

Under the plans, households will receive a £200 reduction in their bills in October which will then be repaid in the following years, however little detail has emerged on how the process will actually work.

Mr Pocklington described the Government response as “inadequate”.

“It’s not timely enough,” he explained.

“This rebating in your energy bill scheme won’t come into effect until Autumn and I think, second and bigger point, this is insufficiently targeted in that the income shocks for poorer households are quite huge right here right now.”

He added that, for those on lower incomes of £20,000 or less, energy bills would be taking up over 10 percent of their income.

While Good Energy is a provider of renewable energy, Mr Pocklington argued environmental costs should not be added to energy bills – and instead should come through taxation.

He claimed: “We are basically paying social security costs through our electricity bill which is a pretty blunt way of doing it.”

A great deal of uncertainty over the future of energy prices now stems from the situation with Russia.

While the UK has little direct reliance on Russian energy exports, a major reduction in Russian oil and gas on global markets would work to drive prices up, resulting in intense volatility since the conflict began.

Mr Pocklington acknowledged that we “didn’t really know” what the outlook might be for prices but predicted that, on current trends, October could now see the price cap reach around £2,500.

A key problem facing Europe currently is storage, with gas reserves now very low, particularly in Germany.

As attempts are made to replenish these over summer, this could in turn further drive up prices.

For consumers navigating the changing energy market, Mr Pocklington warned “there are very few fixed deals out there frankly that look that great at the moment”.

He said: “If anyone is offering you a fixed deal which is less than where we think the price cap might go to then it’s worth looking at.

DON’T MISS:

Gas prices spike as Russia demands ruble payments [INSIGHT]

German inflation reaches 40 year high [REVEAL]

UK likely to avoid recession in 2022 [ANALYSIS]

“Some people are offering those to their existing customers at the moment, they have to stop doing that on April 14.”

After this date suppliers will have to offer new customers the same deals as existing ones. This means more competitive deals could be withdrawn.

Mr Pocklington said: “I don’t think shopping around is necessarily the thing to focus on, the thing to focus on is insulation before next winter because it’s clearly a fact we have the most inefficient housing stock in Europe.”

He predicted there was at least a £300 saving on fuel usage for a better insulated house.

The Spring Statement has offered some assistance with a cut to VAT on home insulation and other improvements such as solar panels and heat pumps.

Source: Read Full Article