Doing your taxes sucks, I’m not going to lie. The government randomly knows how much you owe but you have to figure it out yourself and if you get it wrong you get fined? Seems sus.

But the sooner you do them, the sooner you could get your Economic Impact Payment (your stimmy).

Welcome, again, to “This is America” – a newsletter centered on race, identity and how they shape our lives. I’m Josh Rivera, a Money & Consumer editor at USA TODAY, and my colleagues and I have been answering tax questions for the past month (check our coverage here).

But first: Race and justice news we’re watching

Important stories of the past week, from USA TODAY and other news sources.

- In the year of COVID-19, who has really benefited from the stock market boom?

- Trans visibility: These transgender people transitioned during COVID-19 and are bracing for a return to the office

- Paycheck or caring for family?Without paid leave, people of color often must make the ‘impossible choice’

- The problem with minimum wage: Rationing insulin. Skipping meals. One woman’s struggle to survive on minimum wage

- CEO pay doubled, the minimum wage stayed the same. But Americans still can’t agree on a raise.

Let’s talk stimulus.

For the first and second stimulus checks, the IRS was using Americans’ most recent tax returns available to calculate whether they would get an economic impact payment and how much – during 2020 those would be 2018 or 2019.

Submitting a 2020 return, even if you had no income, would make it possible to claim a stimulus payment because the money was an advance on a tax credit. By filing a return and showing you were eligible for the credit but didn’t receive it, you can claim the stimulus.

But, Josh, “what if I had absolutely no income?” you may ask.

And I would put on my big boy voice and say, “It’s still recommended that you file taxes to keep a record of your financial situation for the year and future assessments.”

Stimulus payments could also indirectly affect what you pay in state income taxes in some states where federal tax is deductible against state taxable income, according to The New York Times. And if you received unemployment assistance, that is also taxable income.

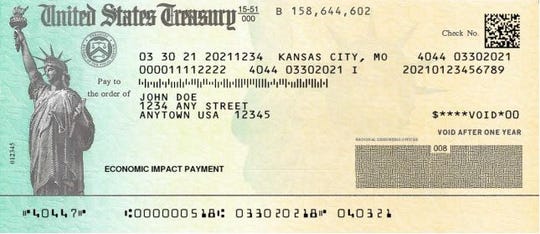

IRS is sending the fourth round of COVID-19 relief checks to over 25 million Americans under President Biden’s American Rescue Plan. (Photo: IRS)

What’s best for recent grads?

The first two rounds of stimulus checks, payments were available for adults and for child dependents under the age of 17. Unfortunately, anyone who was claimed as a dependent on someone else’s return wasn’t eligible for a check of their own, so college students were ineligible.

Submitting a 2020 return will make it possible to claim a stimulus payment because the money was an advance on a tax credit – i.e. the checks were a credit on your taxes.

By filing a return and showing you were eligible for the credit but didn’t receive it, you can claim the stimulus funds you’re due.

Fear not, there’s help.

You can use IRS Free File to prepare and file your federal income tax online for free if your income is below $72,000. For those with income above that amount, you can access IRS’ Free Fillable Forms.

The IRS’ IRS2Go (iOS, Android) is a bare-bones app that lets you check your refund status and schedule payments if you owe money. It can even connect you with an IRS Volunteer Income Tax Assistant.

For simple federal filers, H&R Block, FreeTaxUSA and Credit Karma (now owned by TurboTax’s Intuit) are also available. (Note that these services work for simple filers. Those with additional items to report, like an HSA, investments, have moved or are self-employed might need additional services.)

The tax deadline was extended to May 17 so you have a little more time, but estimated tax payments are still due by April 15. So, if you can, just get it out of the way altogether.

Contributors: Jennifer Jolly and Christie Bieber

Source: Read Full Article