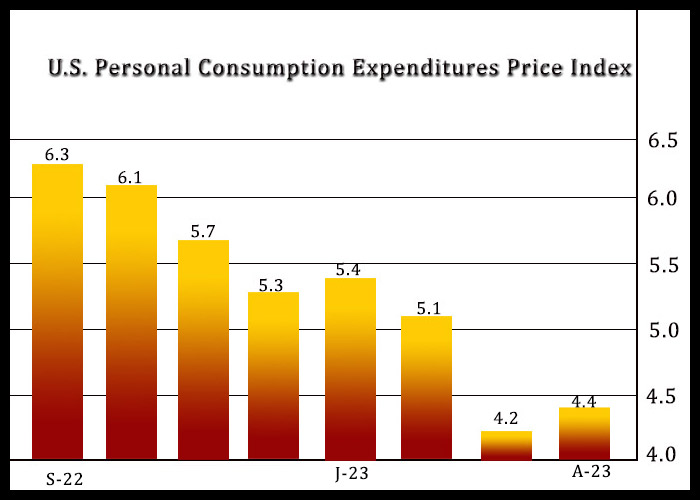

Consumer price growth in the U.S. reaccelerated in the month of April, according to a report released by the Commerce Department on Friday.

The report said the annual rate of consumer price growth accelerated to 4.4 percent in April after slowing to 4.2 percent in March.

The faster consumer price growth came as a surprise to economists, who had expected the pace of growth to slow to 3.9 percent.

The annual rate of growth by core consumer prices, which exclude food and energy prices, also accelerated to 4.7 percent in April after slowing to 4.6 percent in March. Economist had expected the pace of growth to be unchanged.

On a monthly basis, consumer prices rose by 0.4 percent in April after inching up by 0.1 percent in March, while core consumer prices also increased by 0.4 percent in April after rising by 0.3 percent in March.

Ryan Sweet, Chief US Economist at Oxford Economics, said the data will “keep the discussion about the Fed skipping a hike in June and then resume tightening in July alive.”

The readings on consumer price inflation, which are said to be preferred by the Federal Reserve, were included in the Commerce Department’s report on personal income and spending.

The Commerce Department said personal income climbed by 0.4 percent in April after rising by 0.3 percent in March. The growth matched expectations.

Disposable personal income, or personal income less personal current taxes, also rose by 0.4 percent in April following a 0.3 percent increase in March.

The report also showed consumer spending advanced by 0.8 percent in April following a revised 0.1 percent uptick in March.

Economists had expected spending to rise by 0.4 percent compared to the unchanged reading originally reported for the previous month.

Real personal spending, which excludes price changes, climbed by 0.5 percent in April after coming in unchanged in March.

With spending increasing by more than income, personal saving as a percentage of disposable personal income slid to 4.1 percent in April from 4.5 percent in March.

“The combination of inflation moving upward and consumer spending remaining so strong will increase the odds of the Federal Reserve raising rates another time in mid-June,” said Nationwide Chief Economist Kathy Bostjancic.

She added, “However, the final decision will be influenced heavily by the May employment report (due June 2) and the May CPI report due on June 13 – the first day of the FOMC’s two-day meeting.”

Source: Read Full Article