The “Oracle of Omaha” doesn’t like retirees’ chances – at least those on fixed-income investments.

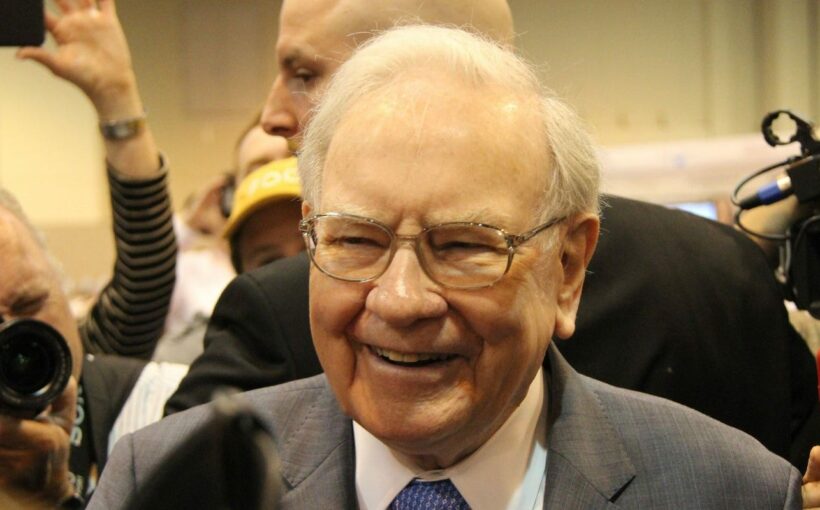

“Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future,” Warren Buffett said in his annual letter to Berkshire Hathaway investors, a document many look to for investment tips and guidance on the future of the economy.

That’s in part because the bond market is ailing as the economy gains momentum despite the COVID-19 pandemic. Buffett noted that in certain foreign countries, including Germany and Japan, fixed-income investors are earning a negative return on sovereign debt investments.

Save better, spend better: We’ll tell you how and send money tips, advice delivered right to your inbox. Sign up here

The implication is that stocks may be the best mechanism to grow your retirement portfolio. Berkshire’s portfolio ranges widely from Geico to Apple to General Motors to Coca-Cola.

The Omaha, Nebraska-based Berkshire chairman, who earned the nickname “Oracle of Omaha” for his successful stock picks, also defended his recent strategy of repurchasing Berkshire shares. He said the plan would build value for existing Berkshire stockholders by limiting the pool of outstanding shares and thus increasing their proportional investment in the company.

Also in his letter, Buffett said he remains confident in the future of the country because “despite some severe interruptions, our country’s economic progress has been breathtaking.”

“Beyond that, we retain our constitutional aspiration of becoming ‘a more perfect union,'” Buffett wrote. “Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so. Our unwavering conclusion: Never bet against America.”

Berkshire Hathaway’s Warren Buffett: ‘Never bet against America’

Warren Buffett’s pandemic investments: Apple is Berkshire Hathaway’s biggest equity investment

Follow USA TODAY reporter Nathan Bomey on Twitter @NathanBomey.

Source: Read Full Article