Inflows into crypto investment products surged last week to levels not seen since July 2022, per data from CoinShares. The spike comes amid growing optimism that the SEC may finally approve a spot bitcoin ETF.

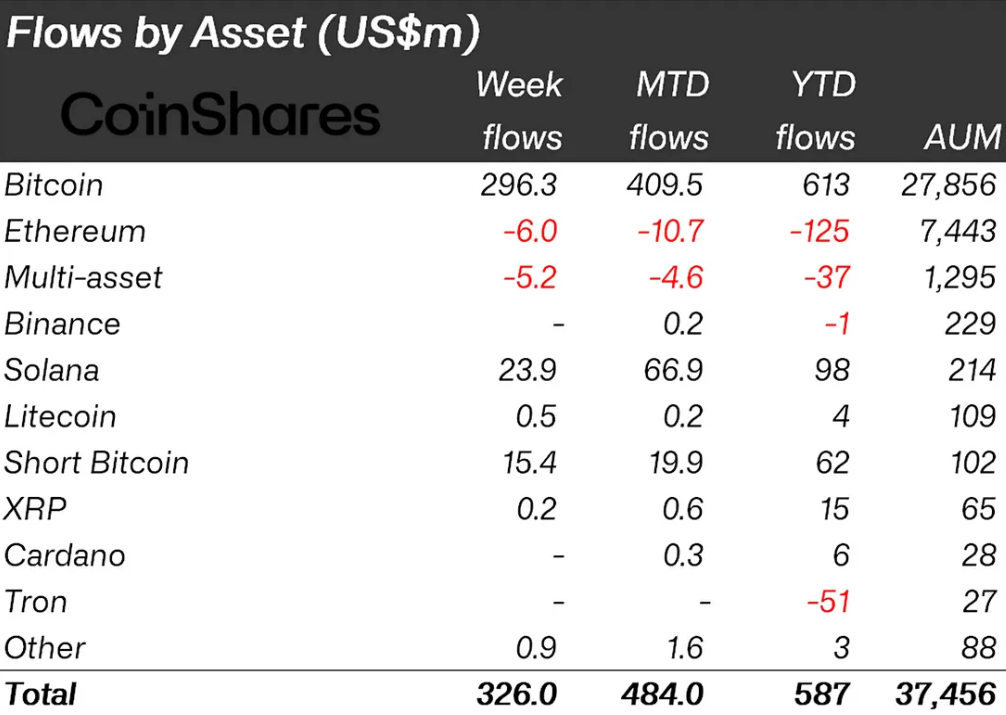

Total inflows hit $326 million, the highest weekly amount in 15 months. Bitcoin products accounted for 90% of inflows at $295 million.

CoinShares head of research James Butterfill partly attributed the momentum to improving sentiment around a bitcoin ETF greenlight. “While positive for Bitcoin, this weekly inflow ranks as only the 21st largest on record, suggesting continued restraint amongst investors,” he wrote.

Surge in inflow, thanks to Bitcoin rally

The price of Bitcoin has rallied 13% over the past week to around $34,650 as of Monday morning.

Several asset managers, like BlackRock, have amended their bitcoin ETF filings recently, likely indicating ongoing talks with the SEC, say experts. Total assets under management in crypto products now sit at $37.8 billion, the most since May 2022.

This marks the fifth straight week of net inflows, signaling renewed investor appetite. Canada and Germany saw the highest country inflows at $134 million and $82 million, respectively. Just 12% came from the U.S., “presumably as investors wait for the spot-based ETF,” noted Butterfill.

The SEC must approve or deny spot bitcoin ETF applications from Ark Invest, 21Shares, and others by January 10th. Many anticipate that the long-awaited first approval could trigger an influx of investments. For now, optimism persists that 2023 may finally bring a spot bitcoin ETF to U.S. markets.

Source: Read Full Article