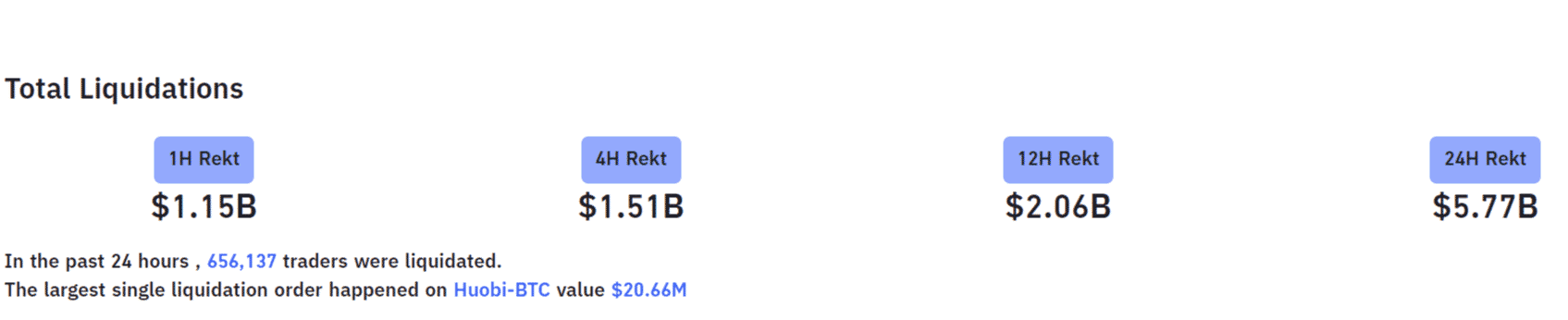

The cryptocurrency market registered a 20%+ collective drop in market cap over the past couple of hours where Bitcoin registered its weekly low of 45,478 and Ethereum fell below $1,400 for the first time in weeks. The sharp price fall of major cryptocurrencies led to the liquidation of nearly $6 billion in leveraged positions in the past 24 hours out of which$1.15 billion contracts were liquidated in the past hour itself.

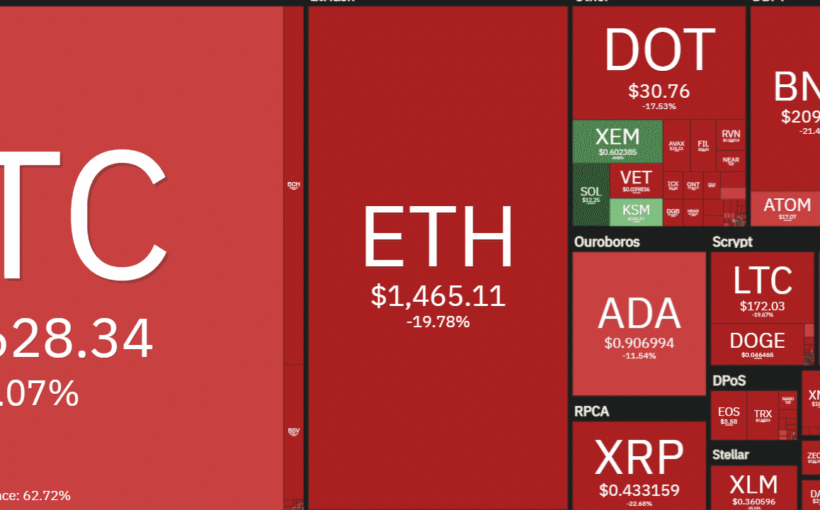

The majority of cryptocurrencies in the top 10 registered fall by over 20% before recovering a little bit. The sharp fall that started yesterday during the Asian time saw a major recovery during the US-time. However, today again the market crashed sharply during peak Asian trading hours. The current liquidation value is among the highest ever recorded in crypto history.

Bitcoin, Ethereum, BNB, and many other altcoins had quite a bullish February registering significant gainst throughout all three weeks before registering a major roadblock today. The heat map is a testimony of the bloodbath that saw the crypto market cap fall by over 20%.

Peter Schiff Take a Pot Shot at Elon Musk Post Bitcoin Correction

Peter Schiff, the famous gold-bug cum Bitcoin critic was quick to take a pot shot at Elon Musk whose company Tesla recently bought $1.5 Billion worth of Bitcoin using treasury cash. Schiff who is a known Gold advocate has been claiming Bitcoin as a bubble even when most of the institutions have started to invest their treasury cash into the top cryptocurrency, and above all Schiff’s own son is a big-time Bitcoin proponent.

Musk responded to Schiff’s Twitter with an emoji in his usual style after claiming Bitcoin to be a better liquidity option than cash and even advocated for Bitcoin over gold while responding to another tweet of Schiff.

Tesla’s $1.5 Billion purchase had already made the company $1 billion within two weeks of their purchase but today’s price fall would have sure put a larger dent in their profit. Musk who is a big-time Doge proponent also received a lot of flak from wall street and even regulators for investing such a large portion of their cash in a volatile asset despite facing cash crunch issues in the past. Musk clarified that his opinions should not be taken as the stand of the companies he represents as those companies have a due decision-making process.

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Source: Read Full Article