DappGambl reports that during the cryptocurrency bull market of 2021/22, Non-Fungible Tokens (NFTs) emerged as a significant phenomenon.

NFTs, or Non-Fungible Tokens, are unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin or Ether, which are interchangeable and identical, each NFT has distinct information or attributes that make it unique. NFTs gained immense popularity for their potential to revolutionize digital art, collectibles, and even real estate. They offered a way to prove ownership and provenance of unique digital items, opening new revenue streams for artists and creators.

According to dappGambl, the market reached an astounding monthly trading volume of $2.8 billion in August 2021. DappGambl notes that these digital assets not only dominated media headlines but also captured the imagination of people around the globe. However, dappGambl emphasizes that the current state of the market is in stark contrast to those peak times, having undergone a significant transformation.

DappGambl cites data from the Block to highlight the NFT market’s sharp decline. As of July 2023, dappGambl reports that the weekly trading volume has plummeted to a mere $80 million. DappGambl points out that this is a drastic reduction, representing just 3% of the peak trading volume recorded in August 2021. DappGambl suggests that this decline is not just noteworthy but unprecedented, emphasizing the market’s volatile nature.

DappGambl provides an in-depth analysis of the current bear market for NFTs. According to dappGambl, the market didn’t just experience a downturn; it crashed severely. DappGambl describes the market as being in a bearish phase, characterized by a pessimistic outlook on the future value of numerous NFT projects. DappGambl notes that this has led to a challenging environment for sellers, as buyers have become increasingly skeptical and cautious.

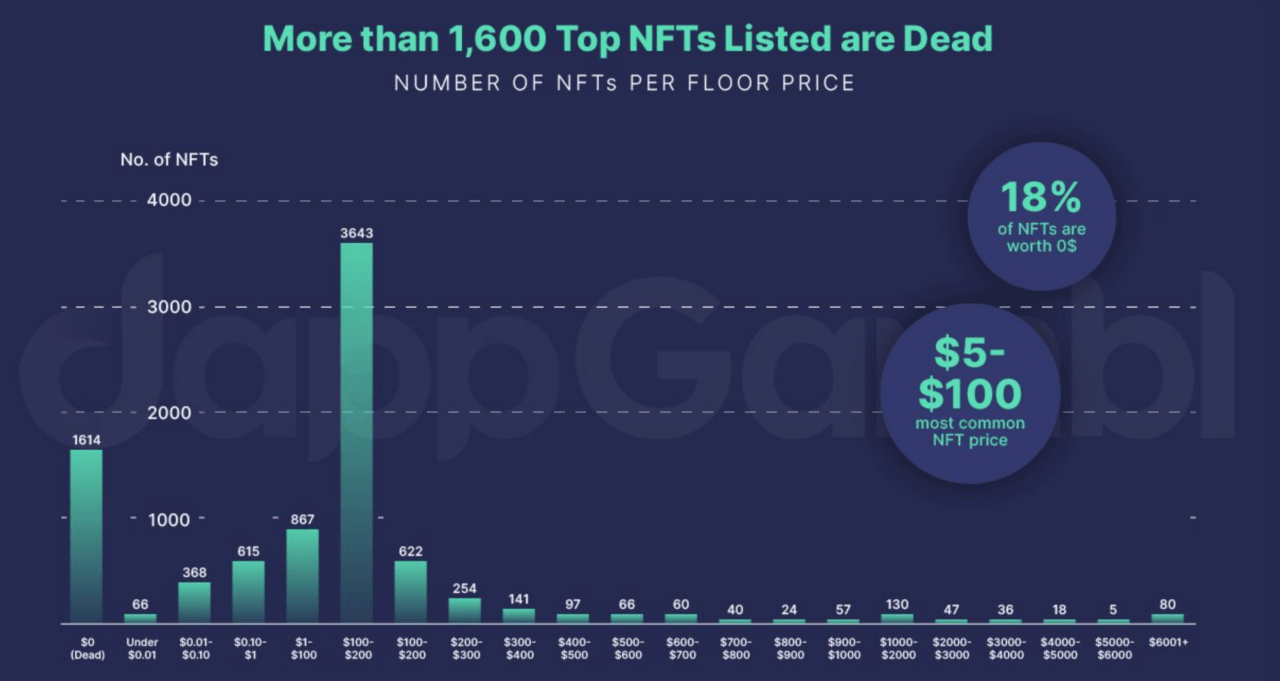

DappGambl reveals a startling fact that the vast majority of NFTs are essentially worthless. According to their findings, out of 73,257 NFT collections identified, a staggering 69,795 of them have a market cap of 0 Ether (ETH).

DappGambl’s report leaves several questions unanswered, adding a layer of complexity to the current and future state of the NFT market. According to dappGambl, it remains unclear whether there are still ‘white whales’ in the market capable of commanding million-dollar deals. DappGambl also questions the long-term viability of NFTs, given the current market conditions. While dappGambl aims to leave readers with a sense of cautious optimism, they acknowledge that the initial market euphoria was unsustainable.

Featured Image via Pixabay

Source: Read Full Article