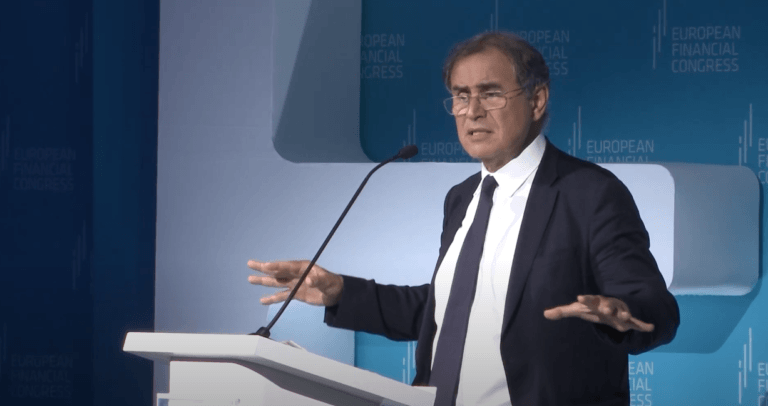

Nouriel Roubini, a globally recognized economist with an extensive academic and policy background, has issued a stark warning about a potential market shock in the near future.

Roubini, who is the CEO of Roubini Macro Associates, a global macroeconomic consultancy firm in New York, and Chief Economist for Atlas Capital Team LP, has a long history of accurate economic predictions. In 2006, he warned of the impending recession due to the credit and housing market bubble, a prediction that became a reality in 2008, leading to a global financial crisis.

In a recent interview with Bloomberg Television’s Francine Lacqua at the Qatar Economic Forum, Roubini shared his concerns about the challenges of inflation and the likely increase in interest rates by central banks. The Daily Hodl reported on Roubini’s predictions, shedding light on his views about the current economic landscape.

Roubini expressed skepticism about the prevailing market sentiment that central banks are done with raising rates. He suggested that inflation will not decrease as much as central banks anticipate, leading to a potential need for further rate increases. This scenario, he warned, could result in a hard landing and financial instability.

The economist also highlighted the complacency in the markets, with investors largely betting on a market recovery prompted by the Federal Reserve cutting rates after a short and shallow recession later this year. However, Roubini cautioned that a market correction is likely before any rate cuts.

“Markets believe that inflation has peaked, and it is going to fall sharply. There may be a short and shallow recession [that] is going to lead them to cut interest rates. So the markets are quite bullish about a short and shallow recession or even a soft landing and then recovery of the markets. Central banks are telling them, ‘No, we’re not done yet. We’re not going to cut the rate this year.’ And there’s even a risk of a correction of the economy. Even the staff of the Fed is expecting a recession later this year.“

https://youtube.com/watch?v=J-3-0NsT6Fw%3Ffeature%3Doembed

Source: Read Full Article