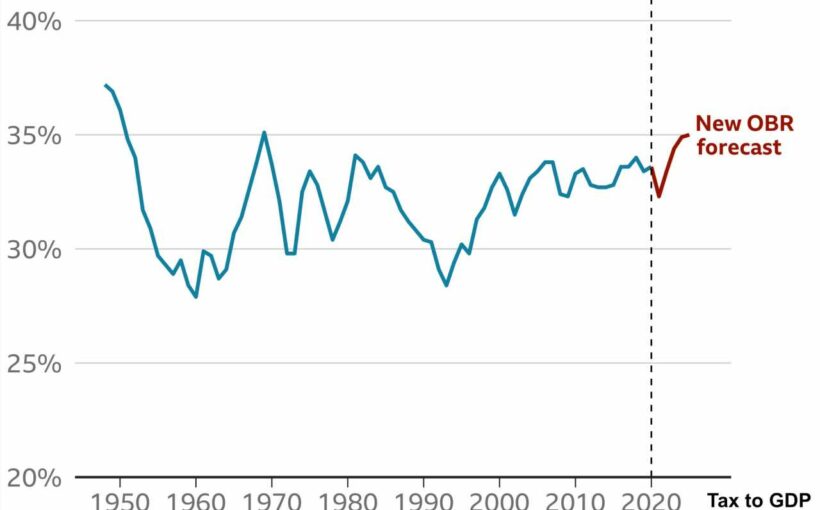

The United Kingdom is to pay the highest level of tax to GDP in nearly a century as Rishi Sunak, the new Chancellor, opens the debate on what’s the best way forward now that the recovery is in sight.

In yet another sign of the complete collapse of the two party system, Labour has not one criticism of the proposal of the chancellor laid down in the budget.

In awkward interviews labour politicians have been cornered to silence, as Sunak maneuvers this Brexit Britain out of 2020.

It is left to the Guardian to shout that Sunak is engaging in “a £65bn raid on household incomes and company profits.”

Yet it is being done somewhat skillfully, with the Chancellor just freezing the tax threshold so that it doesn’t keep up with inflation, meaning technically most will pay 1% or 2% more but it’s just loses on potential gains rather than loses on holdings.

One measure does open him to criticism. He is increasing corporate taxes by 6% from 19% to 25%, but that’s in 2023.

If there is a big bounce in the economy he could just scrap it, especially as it would be near an election year, meaning the tough talk on taxes translates to no actual tax rises at all.

Except on council tax, that’s tax on properties. Out of all things, this is the one labour has criticized to the puzzlement of many because plenty presumed they like wealth taxes, and property is obviously wealth.

In addition this council tax is left to local councils, decentralizing decision making, and thus making this Sunak guy very interesting.

The collapse of labour in the United Kingdom contrasts to the rise of Democrats in the United States where some are cheekingly wondering how all them election court cases are going because stocks haven’t done very well under Biden.

They fear the neo-communists on the left of Democrats who speak with glee of taxing billionaires and some even flaunted the utterly idiotic suggestion of taxing paper profits.

The problem is in an inter-related system disbalance in one part affects all parts because a sell off of assets by the wealthy means impoverishment for all as all working Americans of average income and above have their wealth and pensions in such assets.

Biden is a centrist however, not a neo-communist. Moreover his proposal for a new tax threshold above $400,000 income makes sense because unlike previous decades there are now a lot of people that do get such income due to inflation.

Progressive taxation is the only way that taxation can be acceptable, but one has to take great care in not shocking complex systems.

Instead of setting a hard date when such new tax comes in, which can be frontrun, the new threshold can be progressively introduced in a way that minimizes front-running by starting off closer to the previous bracket and then increasing that bracket.

That however contradicts his pledge to just straight introduce it, but politics isn’t an election, it’s a constant negotiation and markets are great negotiators as Biden must be sweating right now seeing how markets have been performing under him.

Biden too wants to hike corporate taxes from 21% to 28% because there isn’t anything else he can raise without people feeling a direct hit.

However, it must now be dawning to plenty that we are in a trajectory to communism because since the 90s the tax burden has seen only one direction, and that is up.

The Thatcher and Regan economics that gave us the boom of the 90s is now pretty much erased with our economy, where taxes are concerned, back to the war devastated 50s.

This greater and greater sucking in of economic production from value producers to comitburos misallocation has necessarily created this sclerotic growth that we’ve seen for much of this millennium because the state is chocking the economy.

Politicians will point to 2020 and say this is why we’re taking a greater and greater share of the pie, but looking at the stats they must wonder whether they are doing Marx’s bidding in overspending for now decades.

The chief culprit of that overspending is of course the army as a soft arms race rages on with America now spending nearly $1 trillion, or 30% of their tax intake, on destructive toys.

Fear of China or Russia or made up boogimen has kept the public complacent to a greater and greater misallocation of their resources. But this isn’t Russia where their dictator can spend on silly water drones while his people starve. This is America where you’d expect alarm bells to ring at this socialist level of taxation.

Because the culprit of the predicament isn’t 2020. The culprit is decades of borrowing with nothing to show for it as the economy has been sclerotic during those borrowing years because that borrowed money was spent on destruction.

Thus Americans must now demand peace, and instead of shouting at Europe for getting a treaty with China, all three should sit on a table and secure a new peaceful century.

There’s no point going from boogieman to boogieman while the state creepingly eats the economy as these levels of borrowing or of taxation are in no way sustainable, and therefore spending must be cut.

That’s easier said than done however, but there is no other way out than tackling the chief culprit, which is the overspending on the army.

Source: Read Full Article