Kwon stated that Terraform labs will continue to grow the reserves and also said that it would do so “until it becomes mathematically impossible for idiots to claim depeg risk for $UST.” UST is a decentralized stablecoin, unlike Tether and USD Coin.

If there is any confusion left at this point, we will keep growing reserves until it becomes mathematically impossible for idiots to claim depeg risk for $UST $UST is mighty https://t.co/6xCDPWJUTX

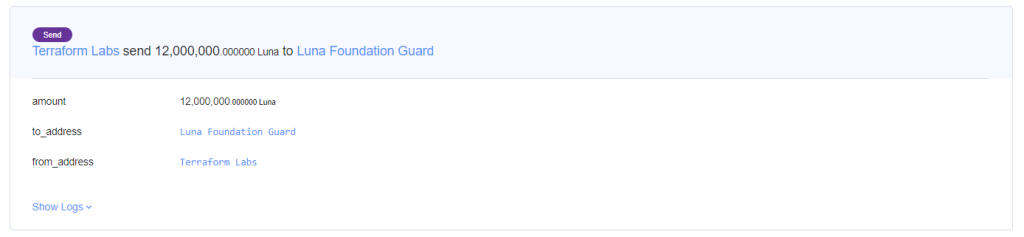

This is not the first time that the UST stablecoin has gotten a boost in its reserves. In late Feb. 2022, the LUNA token experienced a sharp increase in value as $1 billion in bitcoin was added to the reserve.

The burning of LUNA leads to the creation of more UST. The stablecoin is pegged on a 1:1 basis to the U.S. dollar. The ratio is maintained through the alteration of UST and LUNA supplies.

The additions to the reserve will help in the event of volatility in the market. It acts as a reserve in the same way that the holding of foreign reserves by central banks do.

Terraform Labs’ LUNA token has been doing well in the market, but it’s not all going perfect. The SEC has issued a subpoena to the firm and CEO Do Kwon, which was done in public at a conference in New York. The order had to do with potential securities violations.

Stablecoin Market, One To Watch for Regulation

Amid all the subpoena issuances and general stablecoin development, regulators are beginning to take greater note of the stablecoin market. The fear is that they might in some way impinge on the sovereignty of national currencies.

The United States, in particular, is looking at stablecoin regulation. It will be a challenging task to create broad regulation, but with President Biden’s recent executive order, governmental agencies may just have the power.

Decentralized stablecoins used to be risk-on assets during drawdowns – rotation from decentralized to centralized stablecoins due to peg risks. Stark difference now with stablecoins like UST seen as safe-havens. Crypto is down 25% while UST supply is up 28% over the past 60 days pic.twitter.com/BL3mVoLvqF

How that power translates into regulation remains to be seen. As the market undergoes some heavy volatility, market investors are holding on to an increasing amount of stablecoins, so regulators may step in quicker than expected.

Countries are also focusing on their Central Bank Digital Currencies (CBDCs), which see some competition from stablecoins. In any case, 2022 appears to be a year that will see a flood of regulatory actions, good or bad. Stablecoins will certainly be at the center of these changes.

Source: Read Full Article