On 24 July 2023, the Worldcoin project officially launched on the OP Mainnet. The brainchild of co-founders Alex Blania and Sam Altman, Worldcoin aims to create a new identity and financial network accessible to everyone, regardless of their country (local laws permitting, of course), background, or economic status.

The Worldcoin ecosystem is built around three main components. The first is World ID, a privacy-preserving digital identity designed to solve identity-based challenges, including proving an individual’s unique personhood. The second is the Worldcoin token (WLD), a token providing utility and giving users a say over the direction of the Worldcoin protocol. The third is the World App, an app that enables payment, purchases, and transfers globally using digital assets and traditional currencies.

To sign up for World ID, users download the World App, find a local Worldcoin Operator who can verify their unique personhood, and receive their World ID in their World App. This ID can be used in a wide variety of everyday applications without revealing the user’s identity.

The Worldcoin token (WLD) is the first token to be globally and freely distributed to people just for being a unique individual. The amount of WLD that users can claim is consistent across applicable regions. At the moment, eligible verified users can claim 1 free WLD token per week with no maximum.

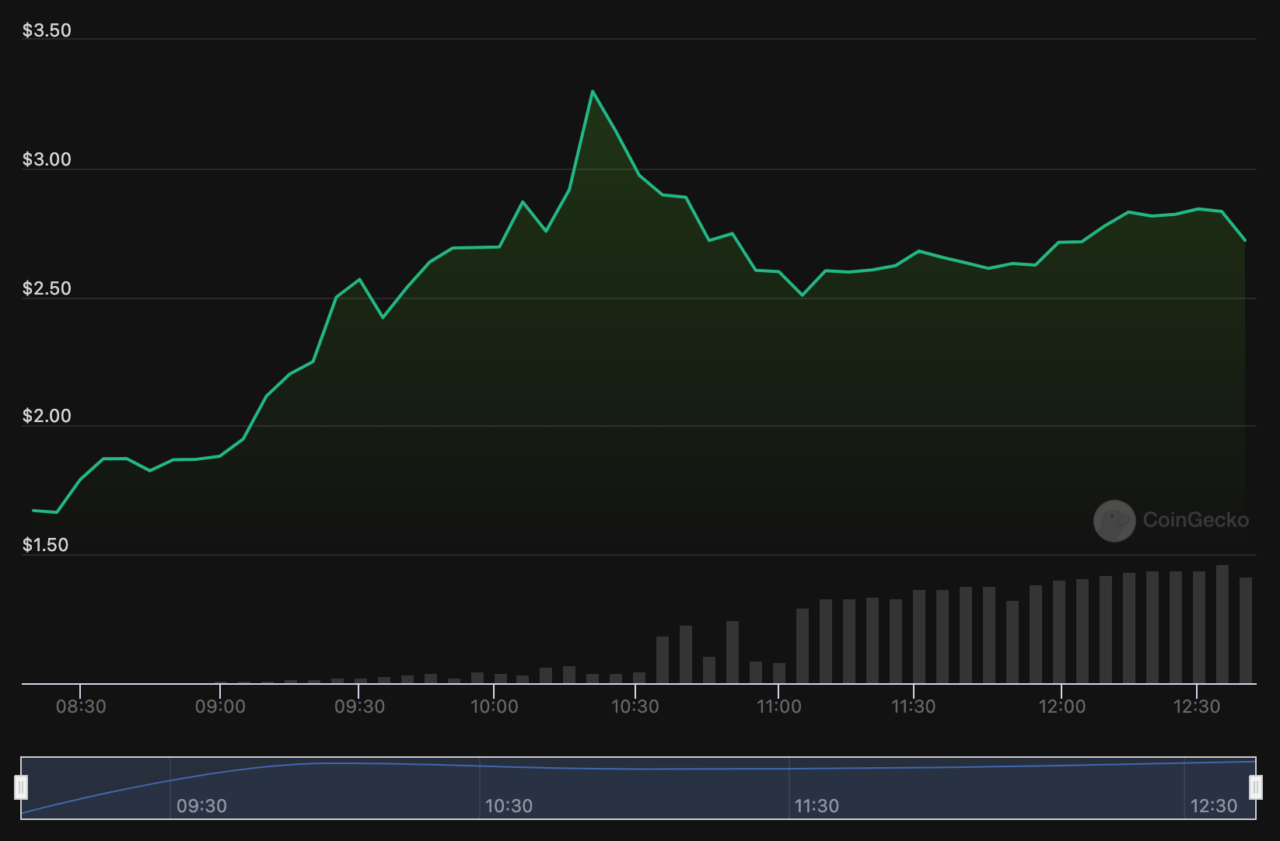

The launch of the Worldcoin project was accompanied by the trading of its WLD token on multiple centralized exchanges, including Huobi, Binance, and Bybit. At the time of writing (11:25 a.m. UTC on 24 July 2023), the WLD token is trading at around $2.70, up 61% on the day, marking a promising start for the project.

In their launch blog post, Blania and Altman expressed their ambition for Worldcoin, stating that if successful, the project could drastically increase economic opportunity, scale a reliable solution for distinguishing humans from AI online while preserving privacy, enable global democratic processes, and eventually show a potential path to AI-funded UBI.

The Worldcoin project represents a significant step forward in the world of digital identity and financial networks. As the project continues to grow and evolve, it will be fascinating to see how it shapes the future of the cryptocurrency landscape.

According to a report by Eliza Gkritsi and Oliver Knight for CoinDesk, “after updating the app, verified users can receive a 25 WLD “genesis grant” to their wallets,” with grants only happening in “countries where regulations allow for them, which doesn’t include the U.S.”

Per CoinDesk’s analysis of the tokenomics, the Worldcoin network has set a cap of 10 billion WLD tokens for the next 15 years. After this period, the network’s governance can decide to introduce an inflation rate of up to 1.5% and determine the distribution of the newly minted tokens. At the time of launch, the maximum circulating supply of WLD is 143 million. Of this, 43 million will be allocated to users verified before the launch, and 100 million will be loaned to non-U.S. market makers for a period of three months.

The distribution of tokens is as follows: 75% for the community, 13.5% for Tools for Humanity investors, 9.8% for the initial development team, and 1.7% held in reserve. The allocation to insiders has been increased to 25% from the initially stated 20% due to the complexity, costliness of the network’s development and launch, and the challenging market environment. Tokens allocated to investors and the team will be locked up at launch and gradually released over the next three years.

All 7.5 billion WLD tokens for the community were minted before the launch, with the aim to allocate 6 billion of these to users over the next 15 years. However, none of the tokens allocated to users are locked up. Not all 2.5 billion WLD for insiders has been allocated yet.

Per an article by Decrypt, “currently, Worldcoin Orbs can be found in Berlin, Dubai, London, Mexico City, Miami, New York City, San Francisco, Seoul, and Tokyo.”

Featured Image Credit: Photo/illustration by geralt via Pixabay

Source: Read Full Article