Amidst a volatile crypto landscape, XRP has emerged as a beacon of resilience, outperforming market leaders like Bitcoin (BTC) and Ethereum (ETH). This notable recovery is underpinned by significant accumulation from large holders, commonly termed as “whales.”

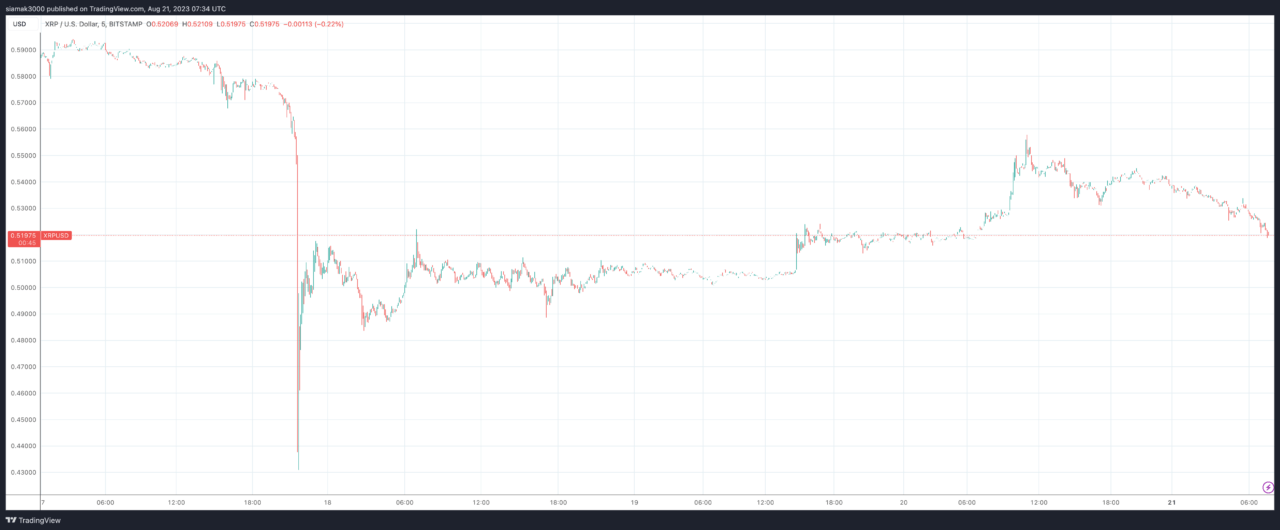

While the broader crypto market has been in turmoil, XRP has demonstrated a remarkable recovery. After a steep 14% drop on August 17, XRP has rallied, surging by over 20% from its low of $0.43090 on August 17 to trade at $0.519 (where it is at the of writing). In comparison, Bitcoin has remained relatively stagnant, and Ethereum, despite a modest rebound, hasn’t paralleled XRP’s recovery trajectory.

Last week, Bitcoin (BTC) experienced a significant drop in its value, marking its most severe weekly decrease since the FTX crash in November 2022. The flagship cryptocurrency’s price went under the $26,000 mark. At its lowest, Bitcoin’s value dropped to $25,392, a price not seen since mid-June. This drastic fall is attributed to a series of liquidations of leveraged trading positions.

On crypto exchange Bitstamp, at the start of the week, Bitcoin was trading at as high as $29,6659, and by Friday, Bitcoin was trading at as low as $25,601, which means a fall of 13.68%, which is not as bad as the 25% drop that occurred between 1 November 2022 and 21 November 2022, but is still the biggest drop in the Bitcoin price since then.

A significant catalyst behind XRP’s resurgence is the aggressive accumulation by large holders.

Data from Santiment reveals:

- 221 addresses, each holding between 10 million to 1 billion XRP, have been in an accumulation mode.

- Their combined holdings have reached a staggering 16.13 billion XRP, valued at $8.71 billion.

- Addresses with 10 million to 100 million XRP have added over 630 million XRP since July 30, amassing a total of 5.11 billion XRP.

- Addresses holding between 100 million to 1 billion XRP have added 1.03 billion XRP since August 16, bringing their total to 11.02 billion XRP.

Santiment also spotlighted the resilience of XRP and other altcoins, including Litecoin (LTC) and Stellar (XLM). Despite the significant market cap decline experienced the previous week, these altcoins have shown signs of recovery. Market value to realized value metrics indicate that traders have faced substantial losses, which could influence market trends in the upcoming days.

Source: Read Full Article