The Bank of Japan maintained its massive stimulus and guidance of ultra-low interest rates and raised the inflation forecast, even as its peers have turned hawkish amid the global inflation surge that is driven by runaway energy prices and supply shortages.

The bank also committed to conduct fixed rate auctions every business day to defend its 0.25 percent yield target.

The central bank’s dovish stance sent the Japanese yen to a 20-year low versus the US dollar and led to a bond rally.

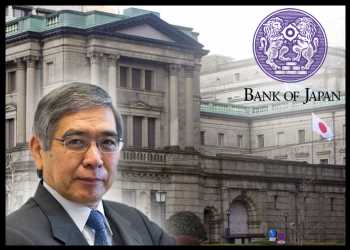

The BoJ policy board, governed by Haruhiko Kuroda, voted 8-1, to hold the interest rate at -0.1 percent on current accounts that financial institutions maintain at the central bank.

The bank will continue to purchase a necessary amount of Japanese government bonds without setting an upper limit so that 10-year JGB yields will remain at around zero percent.

The BoJ clarified that it will offer to buy 10-year JGBs at 0.25 percent every business day through fixed-rate auctions, unless it is highly likely that no bids will be submitted.

As the outline comes under further pressure from continued rises in global bond yields, the BoJ will eventually give itself some breathing space by widening the band from ±0.25 percent to ±0.50 percent, Capital Economics economist Tom Learmouth said.

This announcement could happen at the next Policy Board meeting on June 17. That said, the full abandonment of yield curve control is a remote prospect, Learmouth added.

As the Federal Reserve started tightening its monetary policy, the interest rate gap between the U.S. and Japan widened. Nonetheless, the BoJ continued to focus on the price stability target of 2 percent and continue with the monetary easing stance.

The BoJ downgraded its growth outlook for the current fiscal year citing resurgence of COVID-19, the rise in commodity prices and a slowdown in overseas economies.

The bank estimate the economy to grow 2.1 percent in the fiscal 2021, down from the prior outlook of 2.8 percent. Similarly, the projection for 2022 was lowered to 2.9 percent from 3.8 percent.

However, the projected growth rate for fiscal 2023 is higher, partly owing to a rebound from the lower projection in the previous year. The fiscal growth is seen at 1.9 percent instead of 1.1 percent forecast in January.

Reflecting the impact of the rise in energy prices, inflation outlook for the fiscal 2022 was lifted to 1.9 percent from 1.1 percent. At the same time, the forecast for the fiscal 2023 was maintained at 1.1 percent.

In the fiscal 2024, both inflation and economic growth are seen at 1.1 percent each.

Source: Read Full Article