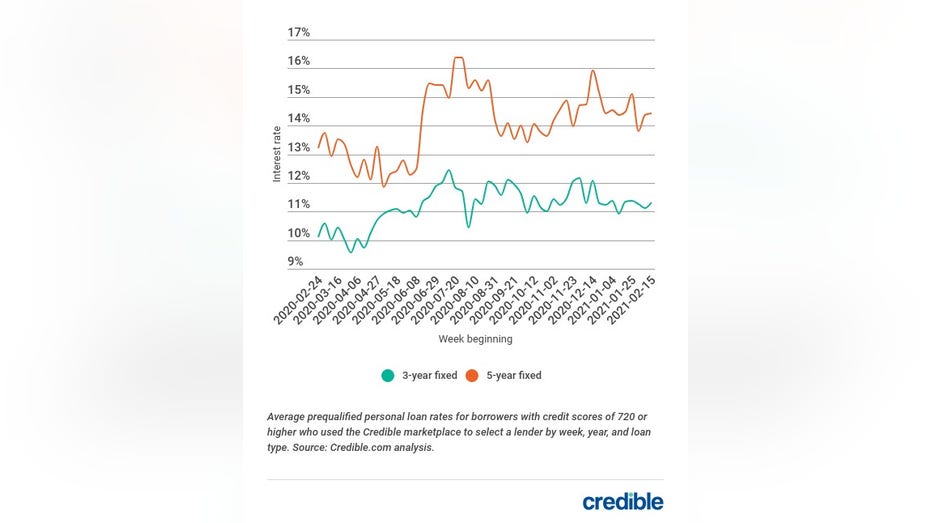

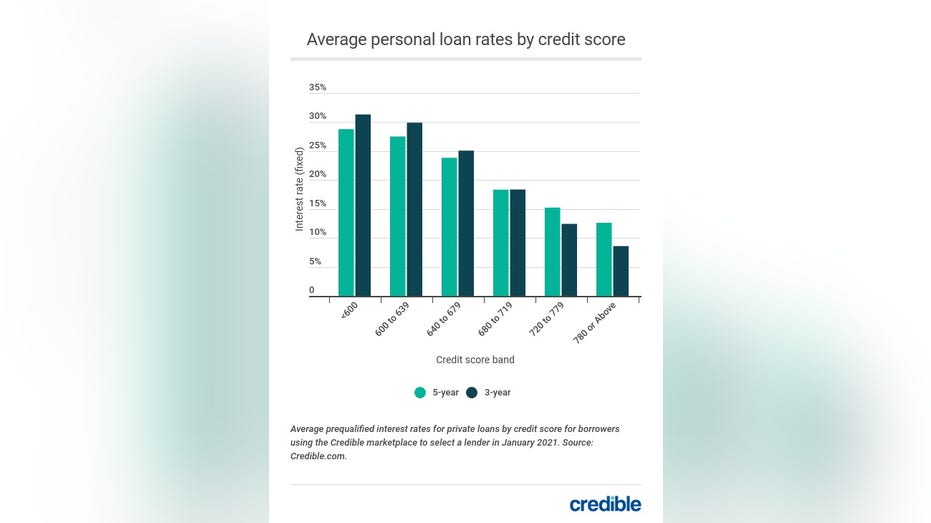

The latest trends in interest rates for personal loans from the Credible marketplace, updated weekly. (iStock) Well-qualified borrowers seeking personal loans during the week of Feb. 15, 2021 prequalified at rates that were slightly higher than a week ago, on average. For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender, during the week of Feb. 1: If you're curious about what kind of personal loan rates you may qualify for, you can use an online tool like Credible to compare options from different private lenders. Checking your rates won't affect your credit score. If you qualify for a personal loan, the interest rate you may be offered can depend on factors like your credit score, the type of loan you’re seeking (fixed or variable rate), and the loan repayment term. The chart above shows that a good credit score can help you get a lower rate, and that rates tend to be higher on loans with fixed interest rates and longer repayment terms. Because each lender has its own method of evaluating borrowers, it’s a good idea to request student loan refinancing rates from multiple lenders so you can compare your options. You can use Credible to compare personal loan rates from multiple private lenders at once without affecting your credit score. Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options ― without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 3,700 positive Trustpilot reviews and a TrustScore of 4.7/5. Source: Read Full ArticlePersonal loan weekly rate trends

Current personal loan rates by credit score

About Credible