Pending home sales in the U.S. unexpectedly increased for the third straight month in February, according to a report released by the National Association of Realtors on Wednesday.

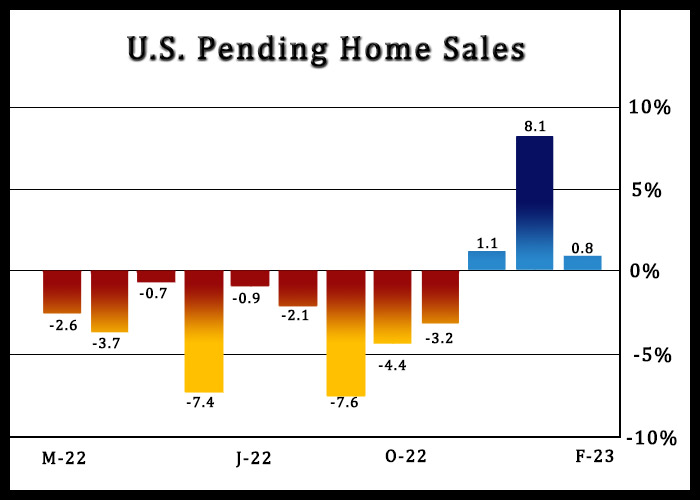

NAR said its pending home sales index climbed by 0.8 percent to 83.2 in February after spiking by 8.1 percent to 82.5 in January. Economists had expected pending home sales to slump by 3.0 percent.

The pending home sales index reached its highest level since hitting 88.3 last August but was still down by 21.1 percent compared to a year ago.

A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale.

“After nearly a year, the housing sector’s contraction is coming to an end,” said NAR Chief Economist Lawrence Yun. “Existing-home sales, pending contracts and new-home construction pending contracts have turned the corner and climbed for the past three months.”

The continued increase in pending home sales was partly due to strength in the Northeast, where pending home sales surged by 6.5 percent.

Pending home sales in the South and Midwest also rose by 0.7 percent and 0.4 percent, respectively, while pending home sales in the West tumbled by 2.4 percent.

“Mortgage rates have improved in recent weeks after the federal government guaranteed the status of most mortgages amidst uncertainty in the financial market,” Yun said.

He added, “While access to commercial mortgage loans could become increasingly difficult, residential mortgage loans are expected to be more readily available.”

Source: Read Full Article