The first full Proof of Stake (PoS) communication between different ethereum clients has completed successfully following the one day devnet dubbed Steklo.

Teku, Lighthouse, Nimbus and Prysm took part from the eth 2 clients, as well as Geth, Besu and Nethermind eth1 clients.

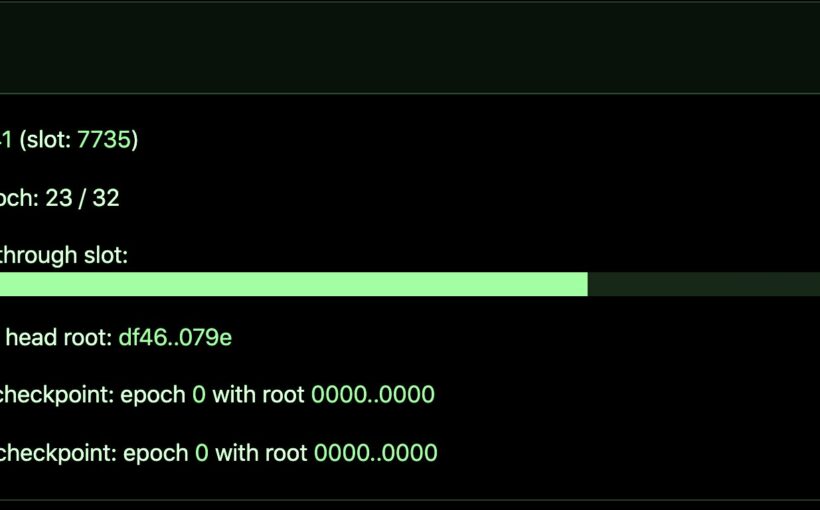

The devenet started fine for a few slots, but quickly fell into numerous forks with this being the very first attempt to get different clients to ‘talk.’

“The testnet is in quite an unstable state right now, and more a tool for devs to debug clients today. We’ll run more user-centric testnets in the coming weeks, once things stabilize enough,” said Diederik Loerakker, an eth 2 dev.

Almost all clients had issues with Loerakker stating that “Lighthouse is building a separate chain from teku+nimbus, and prysm got stuck at genesis.”

That is what you’d expect however from this pre-alpha, with it still a big step in getting from paper to running code. So it was declared a success with Loerakker stating:

“Good work everyone on this first devnet, we made a lot of progress in testnet setup and client integration.”

This is the first time all eth2 and eth1 clients communicated with each other in an emulation of the merger which removes Proof of Work miners and fully upgrades the network to Proof of Stake.

There are some optimistic estimates that the merger might occur as soon as December the 1st, with this devent showing there has been significant progress in getting to the stage where the ethereum network is run by stakers only.

This is to be done by changing the Remote Procedure Call (RPC) direction from miners to stakers, leaving the current ethereum network and its processes fully in tact.

This solution has been prototyped since 2019 and more so since 2020, with it now starting to get a more concrete form.

Following the devnet, which is a testnet environment but for devs as much is still very rough, there will now be longer new devnets and eventually there will be a testnet where the public can participate.

Before miners are removed, there will be a months long testnet that fully and identically replicates the live network, but with fake eth.

The merger can then occur, at which point miners will no longer receive the circa 13,000 eth a day, worth about $40 million currently.

That practically means ethereum will get a boost of $40 million a day, in addition to EIP1559 burning fees which is expected this summer.

So in effect reducing ethereum’s new supply to about 0.22% from the current circa 4%, making the currency the first deflationary in supply as depending on fee levels total supply might fall.

If all goes well, both these fundamental changes to ethereum’s monetary economics should go through by 2022 in giving eth its final form where monetary policy is concerned.

Source: Read Full Article