About 1% of ethereum’s total supply has already moved to newly launched second layers with Arbitrum beginning to dominate.

Some $3 billion is now locked in 17 tracked second layer projects, or 887,000 eth, spiking vertically recently.

Arbitrum has by far the most of assets, with it seeing a jump of more than 3,000% in the past two days after it opened itself to the public.

Optimism is still limited to a whitelist, while the dYdX solution is limited to the platform itself rather than it being a generalized second layer EVM.

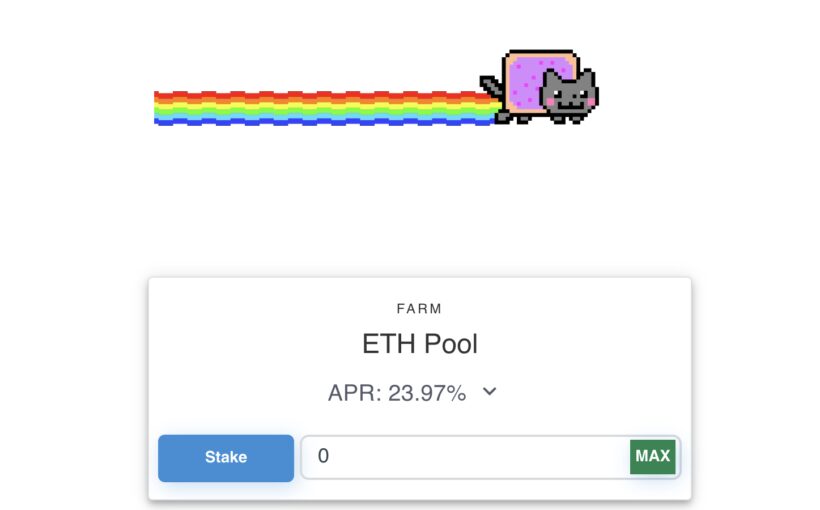

Arbitrum is currently the only such EVM open to the public, and thus projects are already launching there with meme token Nyan attracting some $1.4 billion in assets.

Its token value has plunged however from $8 to 50 cent due to its highly inflationary distribution with people waking up to say they lost everything.

That’s still better than Carbon, a token which doesn’t quite appear to have a purpose for now, but still attracted some $400 million in assets while its token dropped from $40 to $0.01 as its pools gave an APY of 50,000%.

Some new project that was trying to get off in the same style, Pong, just rug-pulled after people deposited even before they put up an interface. The anon dev so grabbing what we estimate is about $1 million, 50 of it in eth and the rest in this pong token.

That’s the new frontier where things are at least happening, although in a way you can easily get burned and in a way that it may affect eth’s price because a lot of these tokens are sent to eth/token pools on Arbitrumed Sushiswap. As you might know by now, that means if token up, then token is sold for eth to rebalance. If token down, then the eth is sold for the token. In the case of Carbon, that means your eth holdings are sold to basically zero.

These tokens had a small market cap however of circa $20 million, and yet for nyan there was an inverse correlation with eth’s price, until it seems bitcoin and eth then ‘plunged’ overnight, down some 5%.

That hard lesson should focus minds with it unclear just how much it will reflect on Arbitrum itself, a much shilled project that has raised some $120 million in Venture Capital. TechCrunch reports:

“[Arbitrum] raised a $20 million Series A in April of this year, quickly followed up by a $100 million Series B led by Lightspeed Venture Partners, which closed this month and valued the company at $1.2 billion. Other new investors include Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, Alameda Research and Mark Cuban.”

Alameda Research. That’s Sam Bankman, the FTX owner who took over Sushi and donated some $10 million to Biden, or the new king on the block as some may well call him.

It is suspected some 150,000 eth was sent to Nyan’s eth pool by Alameda, meaning they took no risk with the price of the token while getting free nyans just for sending the eth to the pool.

Some say they then just dumped the token, with some joking about whether they’ll get an NFT for providing Sam exit liquidity.

This Nyan therefore is maybe more an Alameda creation, and we emphasize that maybe, with the project stating their primary aim was to get people to use Arbitrum.

This second layer however clearly has considerable VC interests, with it stating they will not airdrop a token.

Their revenue is expected to be from validators. The fees you pay on Arbitrum, and for yesterday they were considerable at some $7 per transaction with it handling more than 200,000 transactions that day, go to Arbitrum validators.

Currently, the only Arbitrum validator is the Arbitrum project itself. They have not opened access to the public to run nodes.

It’s not clear when they plan to do so, but that also mean the project is currently unforkable, and thus centralized, with their excuse being they’re still in beta.

They could have waited of course to refine the project first, but they’re facing intense competition from Optimism, another VC backed ethereum second layer.

As stated above, Optimism is still limited to a whitelist, so we have not test run it. Generally they’re both kind of the same in technical design, but what differences there may be in execution remains to be seen once they go public.

You’d think they can’t wait much longer because liquidity in Arbitrum is growing quickly and in many ways liquidity is everything. Yet Arbitrum has not quite had a stellar debut, with the project clearly having a conflict of interest where fees are concerned as they want them to be as high as possible because that’s their revenue.

So Arb clearly can’t be a monopoly, not least because using it feels like using eth a year ago where you have to go to the blockchain for every action, and pay a fee, albeit the fees here are about $5 and the confirmation is almost instant. Yet that’s $5 with 200,000 transactions. In eth at that level fees would be one cent.

It’s all early days however, with plenty of improvements available but it’s not clear how you can improve that fundamental interest to have as high fees as possible, just like eth miners.

A token would go some way towards having a more attuned governance for such issues, but that would bring its own problems, and potentially existentially so for the project if it is used to pay network fees, so replacing eth.

However, the token’s governance utility can gain its value through being entitled to a percentage of validator’s fees, fees which are still paid in eth but instead of all going to the node runners, some go to the token holders.

Such token is inevitable for a decentralized project you’d think because if the project doesn’t launch it itself, it would be forked and in the process maybe even poach some of the talent.

Any second layer running on eth necessarily has to be decentralized if it wants to be general purpose, and thus just as in the first layer you have the eth token and the nodes, so in the second layer you’d think, but what experimentation will bring up, remains to be seen.

A different second layer from these two competitors is zk rollups, which are more a method of on-chain compression, but they’re still in development for generalized usage.

Starkware leads there with it working towards a fully decentralized StarkNet. Currently they’re being used within a single dapp where once you get in, you don’t interact with the blockchain anymore until you get out.

That pretty much perfect design from an end-users perspective has maybe spoiled us a bit as it isn’t clear what it will feel like when dapps can interact with each other on the second layer, but they claim they can fit some 600k transactions in a single block, though we presume in a lab environment.

All this means the transition from dial-up has began and is set to intensify, but just how it develops and what tradeoffs may be made in the process, remains to be seen.

Source: Read Full Article