LONDON (Reuters) – Amsterdam edged ahead of London to become Europe’s biggest share trading centre in January, benefiting from Brexit forcing European Union investors to use platforms inside the bloc.

Exchanges in the Dutch capital traded 9.2 billion euros ($11.15 billion) a day in January, more than London’s 8.6 billion euros, according to figures from Cboe Europe exchange, which operates in both cities.

This compares with an average of 17.5 billion euros traded daily in London during 2020, when Frankfurt was second with 5.9 billion euros a day, and Amsterdam sixth at 2.6 billion daily, Cboe said.

However, trading in Swiss shares resumed in Britain this month. It is averaging 250 million euros a day and is expected to build up towards over a billion euros daily – the level before trading of Swiss shares in London stopped in June 2019.

The rise of Amsterdam was well flagged as pan-European share platforms Cboe and London Stock Exchange’s Turquoise in London began preparations for opening hubs in the Dutch capital after Britain voted in 2016 to leave the EU.

Over 6 billion euros in daily trading left London on Jan. 4 for EU-based platforms such as Cboe and Turquoise, but also increasing trading on national exchanges.

Brussels had been clear it wanted euro-denominated financial activity shifted from London to build up its own capital market and have direct supervision.

Some derivatives trading has also moved from London to Amsterdam and ICE exchange announced this week that trading in EU carbon emissions will move from London to the Dutch city later this year.

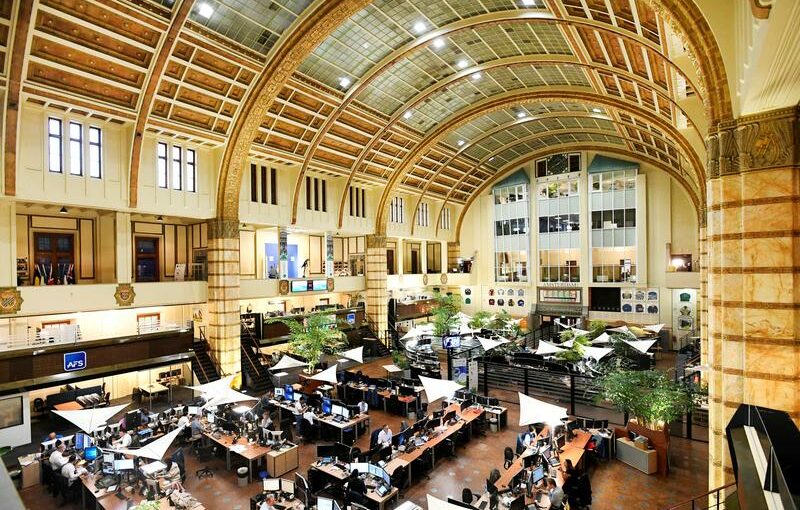

Pan-European exchange Euronext, which runs the Amsterdam stock exchange, said on Wednesday it has seen an increase in volumes and activity in stock markets since Brexit.

($1 = 0.8251 euros)

Source: Read Full Article