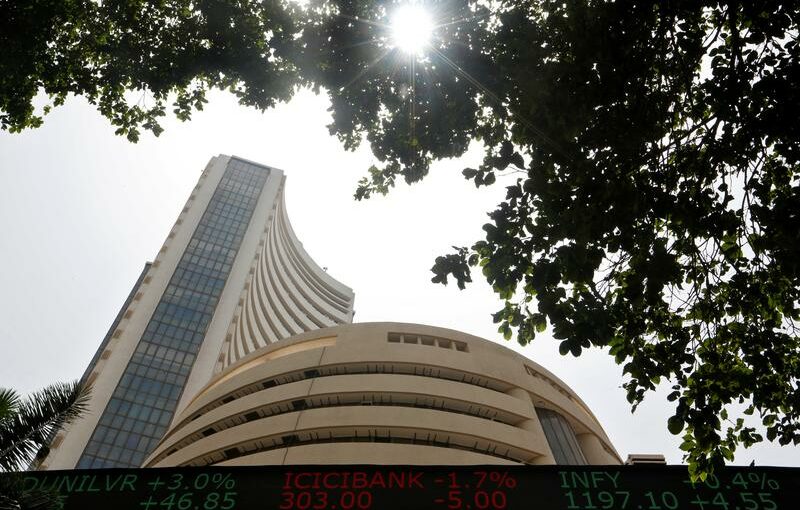

BENGALURU (Reuters) – Indian shares ended flat on Wednesday as major private bank stocks slipped and offset sharp gains in Coal India, while media firms soared on news of Zee Entertainment merging with a rival.

The blue-chip NSE Nifty 50 index closed 0.09% lower at 17,546.65, while the S&P BSE Sensex fell 0.13% to 58,927.33.

Investors also awaited the results of a two-day U.S. Federal Reserve meeting later in the day, where the central bank is expected to give cues on a possible tapering of its bond buying program.

An indication of tapering would likely impact the market and “suck out some liquidity”, said K.K. Mittal, an investment advisor with Venus India.

Private banks fell 0.7%, erasing gains from the previous session, with Housing Development Finance Corp shedding more than 1% to be among the biggest losers on the Nifty 50.

Media stocks posted their best day ever as Zee Entertainment surged 39% on its board approval for a merger with Sony Group Corp’s Indian unit, a week after the Indian media giant’s top shareholders had asked for a management reshuffle.

Real estate stocks jumped 8.5%, with Godrej Properties adding 13.2% to lead the charge in the sector.

Analysts have said signs of improving sales on easing COVID-19 restrictions is helping sentiment, with a rise in large asset purchases expected during the upcoming festive season.

Auto stocks ended 1.3% higher, as analysts pointed to similar factors aiding gains in the sector.

Consumer stocks fell, with Nestle India dropping nearly 1.5% to be the top loser on the Nifty 50. On Tuesday, the company’s chairman told here local media there were no sure signs that sustained consumption is here to stay.

Source: Read Full Article