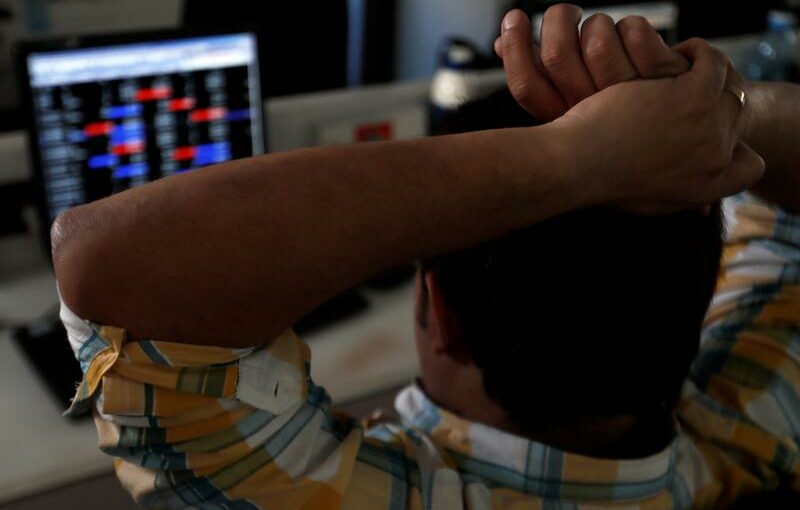

BENGALURU (Reuters) – Indian shares fell on Monday, dragged by HDFC Bank as it missed quarterly profit expectations, with sentiment further dented by broader Asian peers falling in early trade on a renewed coronavirus scare.

By 0458 GMT, the NSE Nifty 50 index was down 0.65% at 15,820.10 and the S&P BSE Sensex was down 0.7% at 52,765.11.

HDFC Bank dropped as much as 3.2%, its lowest in nearly a month, after the lender reported a quarterly profit that missed expectations on Saturday as bad loan provisions rose and asset quality deteriorated. The NSE Nifty Bank index was down as much as 1.3%.

However, analysts said the troubles facing India’s largest private sector bank by market capitalization were temporary.

“The market’s reaction seems to be a very knee-jerk one, and we expect a recovery across sectors in the second-half of the day,” said Gaurav Garg, head of research at CapitalVia Global Research, Indore.

Investors will focus on telecom stocks with the Supreme court set to hear adjusted gross revenues (AGR) case later in the day. India’s top court, in September last year, reaffirmed dues payable by telecom companies Bharti Airtel and Vodafone Idea.

The drag in banks was offset slightly by realty and tech stocks, as investors eye results from HCL Tech, ACC and HDFC Life among others.

The Indian parliament’s monsoon session begins on Monday with issues such as petrol prices, the country’s COVID-19 status and farm issues up for discussion.

Garg said analysts will watch the pace of India’s monsoon rains and agro stocks over the next few weeks.

Asian shares slipped to a one-week low on Monday and perceived safe haven assets, including yen and gold, edged higher amid fears of rising inflation and a surge in coronavirus cases, while oil prices fell on oversupply worries.

Source: Read Full Article