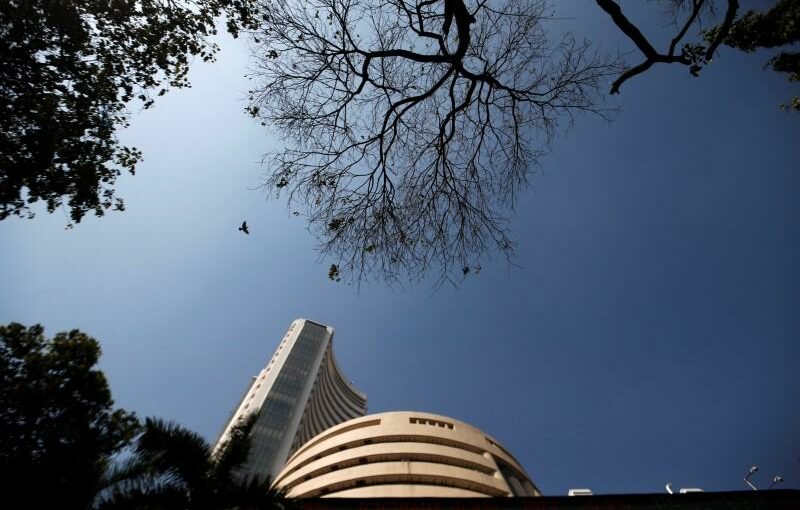

BENGALURU (Reuters) – Indian shares hit record highs on Wednesday, led by financial and metals sectors, as the blue-chip Nifty 50 index’s break above the key psychological 16,000-level brought fresh impetus into the market and boosted investor sentiment.

By 0504 GMT, the NSE Nifty 50 index climbed 0.92% to 16,281.35 and the benchmark S&P BSE Sensex rose 0.93% to 54,325.29.

“The momentum that has come after a clean break of 16,000-mark seems to have brought in or at least attracted fresh buyers. We have broken a month-long excruciatingly tight range of 400 points,” said Anand James, chief market strategist at Geojit Financial Services.

The breakout has also prompted several short-coverings and triggered buying in banking stocks, which were major laggards in the past few weeks, James said, adding that the rally seems to be driven mostly by the Nifty 50 components.

The Nifty Bank index, which shed more than 3% in the past two weeks, added 1.7% on Wednesday. The Nifty Financial Services Index rose 2%, while the metals sub-index gained 1.5%. HDFC Ltd was the top gainer on the Nifty 50 index, rising 4.1%.

Analysts also said strong quarterly results were aiding sentiment.

Telecom operator Bharti Airtel Ltd rose 0.3% after reporting a 15% increase in first-quarter revenue on Tuesday, helped by higher data usage and subscriber additions.

Adani Ports and Special Economic Zone Ltd rose as much as 2% after reporting two-fold rise in June quarter profit.

Meanwhile, India’s central bank begins its three-day policy meeting on Wednesday, where it is expected to leave interest rates at record lows for a seventh straight time on Friday. Markets are keeping an eye on liquidity measures about to be taken by the central bank.

Source: Read Full Article