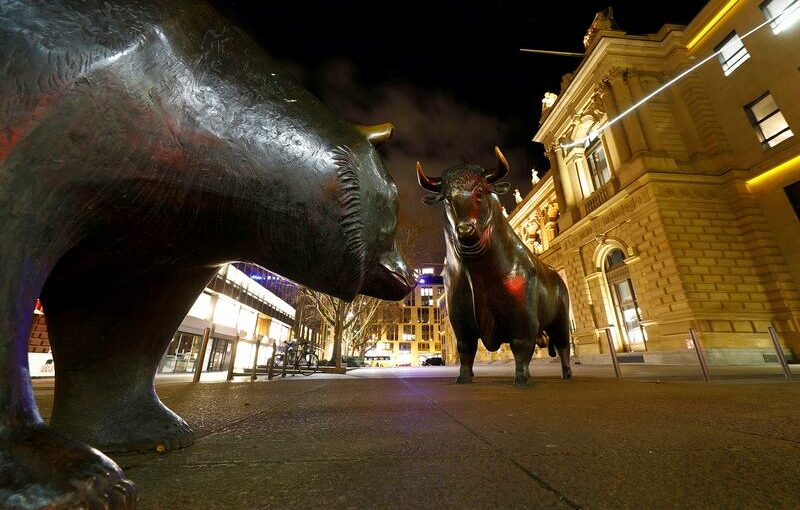

(Reuters) -European stocks climbed for a second straight session on Thursday, as construction stocks gained on upbeat sales forecast from Saint Gobain and commodity-linked shares rose on hopes of larger U.S. stimulus after Democrats won Senate control.

The pan-European STOXX 600 index advanced 0.2% to hold near February 2020 highs, while London’s blue-chip FTSE 100 gained 0.4% and Germany’s DAX index was up 0.5%.

Construction & material stocks were the top gainers, led by a 5.9% surge in France’s Saint Gobain after it said fourth-quarter results would significantly exceed expectations.

Meanwhile, economically sensitive sectors such as mining , energy and industrials extended their rally on the prospects of more U.S. stimulus after Democrats won control of the Senate.

Gains in Swedish industrial companies Atlas Copco, Sandvik and Volvo drove Stockholm stocks to all-time highs.

“We highlight that Basic Resources, Construction & Materials have underperformed since the beginning of December and, given their sensitivity to fiscal policy in general through infrastructure investment, they have catch up potential,” Unicredit analysts said in a note.

European wind turbine makers Vestas, Orsted and Siemens Gamesa all extended gains from the previous session.

Renewable stocks are widely considered as winners of a Joe Biden administration, given the U.S. president-elect’s proposed $2 trillion climate plan.

Sentiment was also boosted by European approval for a second COVID-19 vaccine developed by Moderna Inc.

Meanwhile, demand for German-made goods defied expectations, rising 2.3% in November, the latest in a string of data points showing the Europe’s largest economy being unexpectedly resilient in the face of the pandemic.

Among other movers, LafargeHolcim rose 1.4% after the world’s biggest cement maker said it would buy Firestone Building Products from Bridgestone Americas in a deal worth $3.4 billon.

Delivery Hero slipped 1.4% after the German food delivery firm said it raised around 1.2 billion euros ($1.48 billion) by issuing new shares to fund growth.

Mitchells & Butlers tumbled 7.6% after the British pub operator said it was exploring an equity capital raise as a new national lockdown shut its sites across England.

Source: Read Full Article